What conditions do I need to meet to get a personal loan approved online?

The specific conditions required for online approval of a personal loan can vary depending on the lender and the type of loan. However, several common factors are generally considered:

-

Minimum Age: Typically, you must be at least 18 years old to apply for a personal loan. Some lenders may require applicants to be older, such as 21 or 25 years old.

-

Stable Income: Lenders usually require proof of a steady income to ensure you can repay the loan. Employment, regular salary, business income, or other sources of stable revenue may be considered.

-

Good Credit Score: While some lenders cater to borrowers with less-than-perfect credit, a higher credit score improves your chances of approval and may lead to better terms and interest rates.

-

Low Debt-to-Income Ratio: Lenders assess your debt-to-income ratio (the amount of debt you have compared to your income). A lower ratio often indicates better financial health and improves your chances of loan approval.

-

Residency or Citizenship: You may need to be a resident or citizen of the country where you’re applying for the loan.

-

Valid Identification: You’ll likely need a government-issued ID, such as a driver’s license, passport, or national ID card, to verify your identity.

-

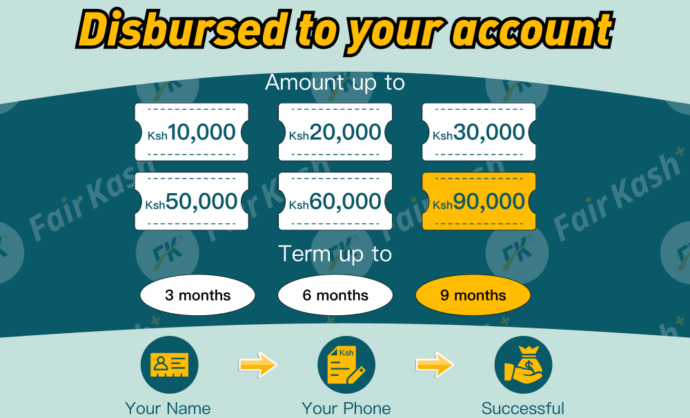

Bank Account: Having an active bank account may be a requirement for receiving the loan funds.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Proof of Address: Lenders may ask for proof of your current address, such as utility bills or official documents, to confirm your residency.

-

Employment History: A stable job or a consistent work history can strengthen your application, demonstrating your ability to repay the loan.

It’s essential to check the specific eligibility criteria outlined by the lender. Different lenders have varying requirements, and some may consider alternative factors beyond the traditional criteria. Additionally, meeting these conditions doesn’t guarantee approval, but they often play a significant role in the lender’s decision-making process.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status