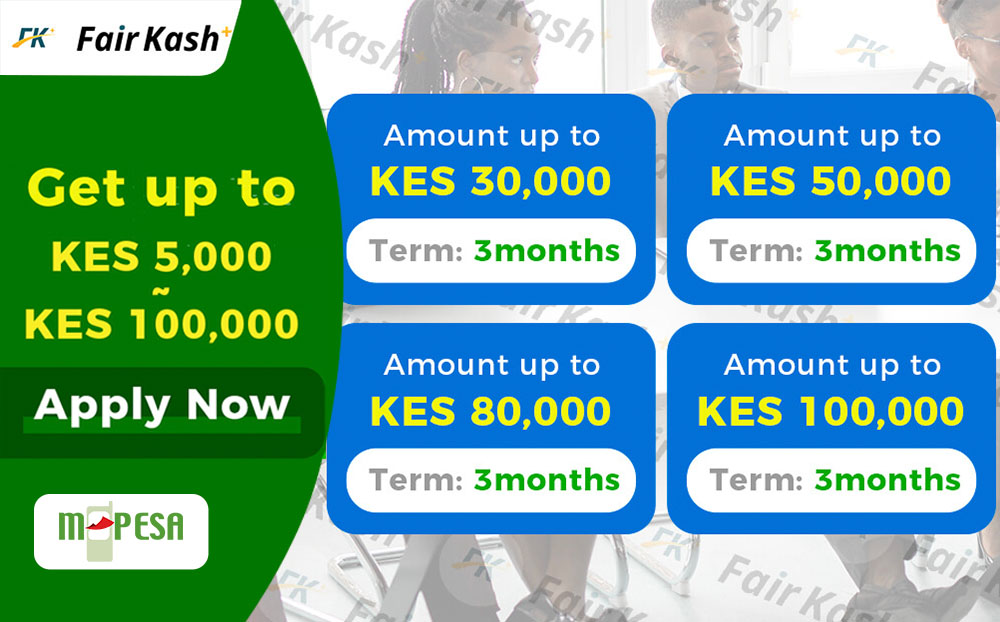

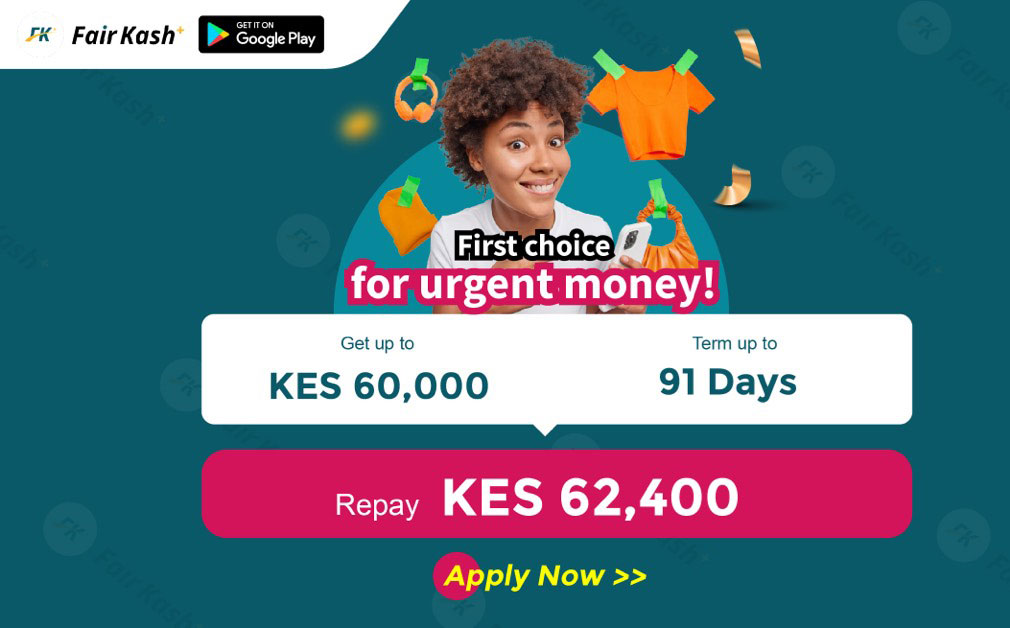

What is the interest rate for fast online MPESA loans?

MPESA is a mobile phone-based money transfer and microfinance service that allows users to send and receive money, pay bills, and access loans. One of the key features of MPESA is the availability of fast and convenient online loans. In