How is the best loan application different from a traditional loan?

The emergence of best loan applications like Fairkash+ has revolutionized the borrowing landscape, offering a distinct contrast to traditional loans. Understanding these differences can help borrowers make informed decisions when seeking financial assistance.

Speed and Convenience: One of the most apparent differences lies in the application process. Best loan applications, exemplified by Fairkash+, prioritize convenience and speed. Unlike traditional loans, which often involve lengthy paperwork and visits to physical banks, Fairkash+ streamlines the process, allowing users to apply online or via a mobile app, reducing the time and effort needed.

Online Accessibility: Traditional loans typically require borrowers to visit a physical branch, which might not be convenient or feasible for everyone. Best loan applications, such as Fairkash+, offer online accessibility, enabling users to apply, track their application, and manage their loan entirely through digital platforms, making it more accessible and user-friendly.

Approval Time and Disbursement: The speed of approval and disbursement is another significant contrast. Traditional loans might take several days or weeks for approval and fund disbursal. Fairkash+ excels in quick approval times and immediate fund disbursement, addressing urgent financial needs promptly.

Credit Score Emphasis: Traditional loans often heavily rely on credit scores as a decisive factor for approval. In contrast, best loan applications like Fairkash+ consider various factors beyond credit scores when assessing loan applications, making loans accessible to a more extensive range of applicants with varying credit profiles.

Fee Structure and Transparency: Fee structures in traditional loans may involve hidden charges or complex terms, making it challenging for borrowers to understand the total cost. Conversely, best loan applications prioritize transparency, clearly outlining fees, terms, and conditions upfront. Fairkash+ emphasizes a transparent fee structure, ensuring borrowers understand all costs associated with the loan.

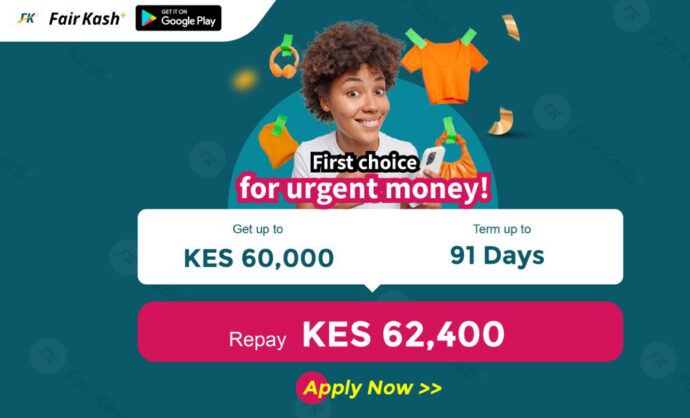

Loan Amount and Repayment Options: Traditional loans might have fixed loan amounts and limited repayment flexibility. Best loan applications like Fairkash+ offer more customizable loan amounts and various repayment options, allowing borrowers to choose terms that best suit their financial situation.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Customer Service and Support: The level of customer service differs significantly between the two. While traditional loans may offer in-person assistance at branches, best loan applications like Fairkash+ provide responsive and supportive customer service through various channels, addressing queries and concerns effectively.

Security Measures: Security measures also vary. Traditional loans might involve physical documents that pose security risks. Best loan applications prioritize data security, employing robust encryption and security measures to protect users’ personal and financial information.

In conclusion, the best loan applications, exemplified by Fairkash+, offer a paradigm shift from traditional loans by prioritizing speed, accessibility, transparency, and flexibility. Their digital platforms, customer-centric approach, and modernized processes cater to the evolving needs of borrowers, creating a more convenient and inclusive borrowing experience.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status