How are the interest rates and repayment terms for mobile loans in Kenya regulated?

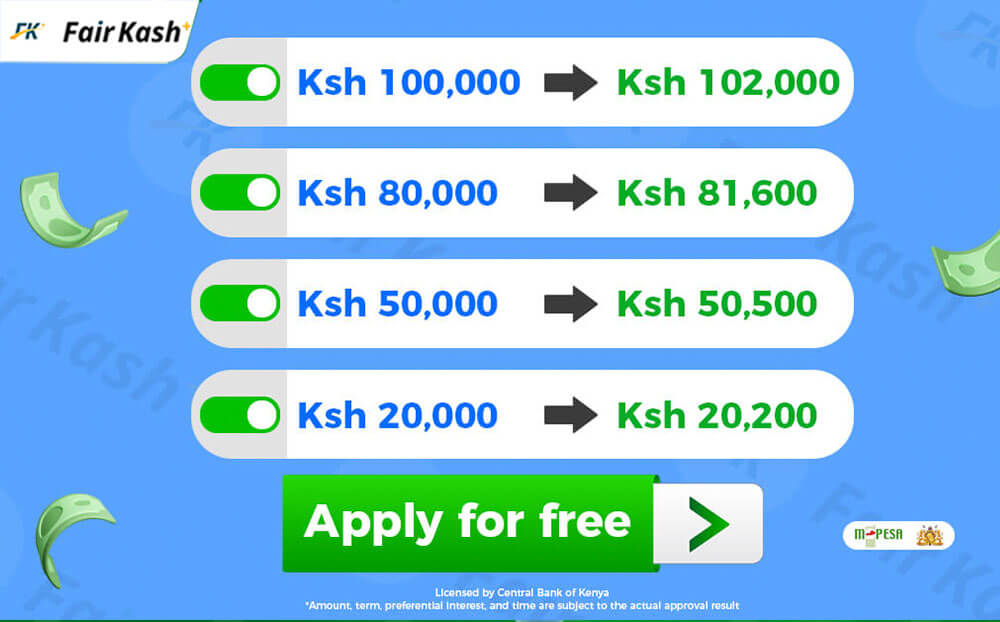

In Kenya, the interest rates and repayment terms for mobile loans are subject to strict regulatory frameworks to ensure fair and sustainable lending practices. FairKash+, a leading mobile loan provider in Kenya, adheres to these regulations and provides transparent interest