How do I choose the fast loan app that’s right for me?

Finding the Right Fast Loan App: A Comprehensive Guide with Fairkash+

Understanding Your Needs and Preferences

The journey begins by identifying your specific requirements, financial constraints, preferred loan amount, repayment terms, and urgency. This section guides readers through the critical self-assessment necessary before choosing a fast loan app.

Assessing Loan App Features

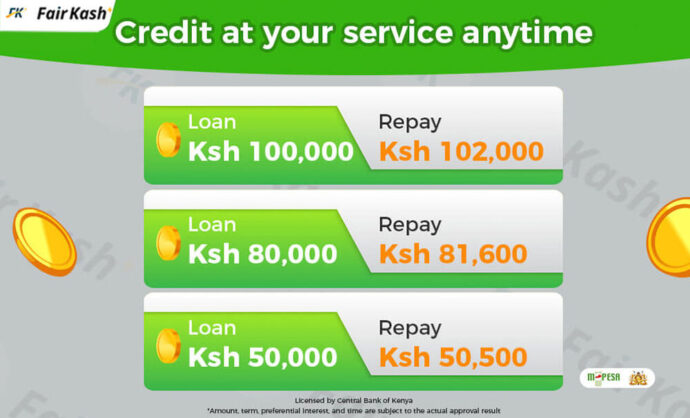

Explore and compare the key features offered by different fast loan apps. Highlight the importance of interest rates, repayment flexibility, loan amounts, processing speed, eligibility criteria, and customer support.

Fairkash+: A Closer Look

Dive deep into Fairkash+’s standout features, emphasizing its strengths in terms of interest rates, loan limits, repayment flexibility, and ease of application. Include user experiences and reviews to add credibility.

Understanding Loan Terms and Conditions

Elaborate on the importance of comprehending loan terms and conditions. Discuss how Fairkash+ communicates its terms, ensuring transparency, and helping borrowers make informed decisions.

Exploring User Experiences

User experiences play a pivotal role. Incorporate testimonials or case studies about borrowers’ experiences with Fairkash+ to offer insights into its effectiveness and reliability.

Factors Influencing Decision Making

Discuss additional factors impacting decision-making, such as customer service quality, app user-friendliness, and data security measures. Offer insights on how Fairkash+ excels in these areas.

Navigating Application Processes

Detail the application process for Fairkash+ and other apps, highlighting ease of use, document requirements, and approval timeframes. Demonstrate Fairkash+’s simple and user-friendly application process.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Comparative Analysis

Present a comparative analysis, weighing Fairkash+ against other leading fast loan apps. Focus on differentiating features, interest rates, maximum loan amounts, and overall user experience.

Conclusion: Making the Right Choice

Summarize the key factors to consider when choosing a fast loan app and highlight how Fairkash+ meets these criteria. Empower readers to make an informed decision that aligns with their financial needs and preferences.

This article provides a comprehensive guide for individuals seeking the right fast loan app, emphasizing Fairkash+ as a standout option. It covers self-assessment, app features, loan terms, user experiences, application processes, and comparative analysis, guiding readers towards making an informed and suitable choice.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status