Is it possible to pay back early in a quick online mpesa loan?

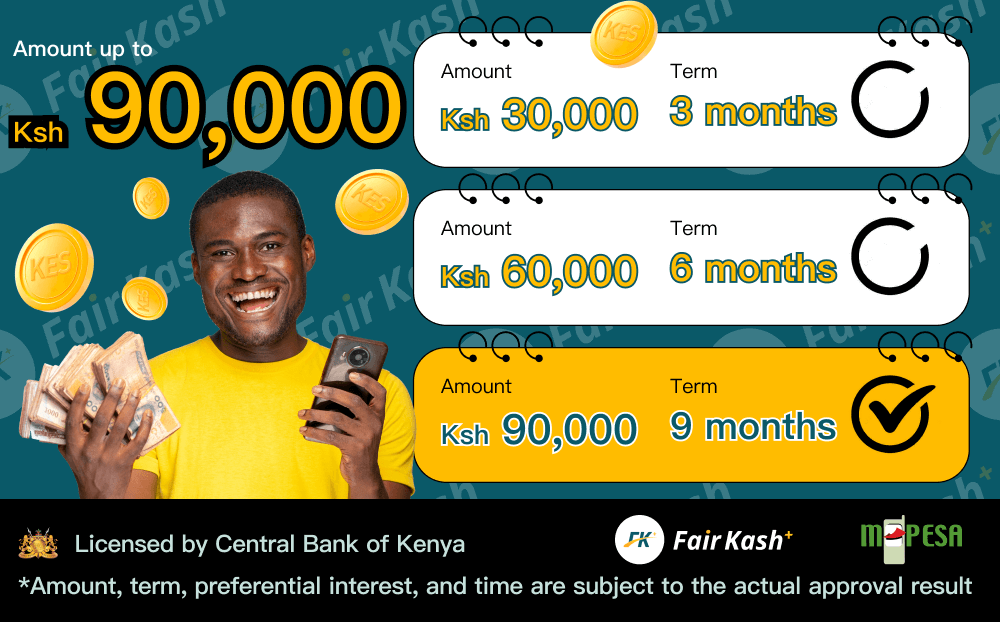

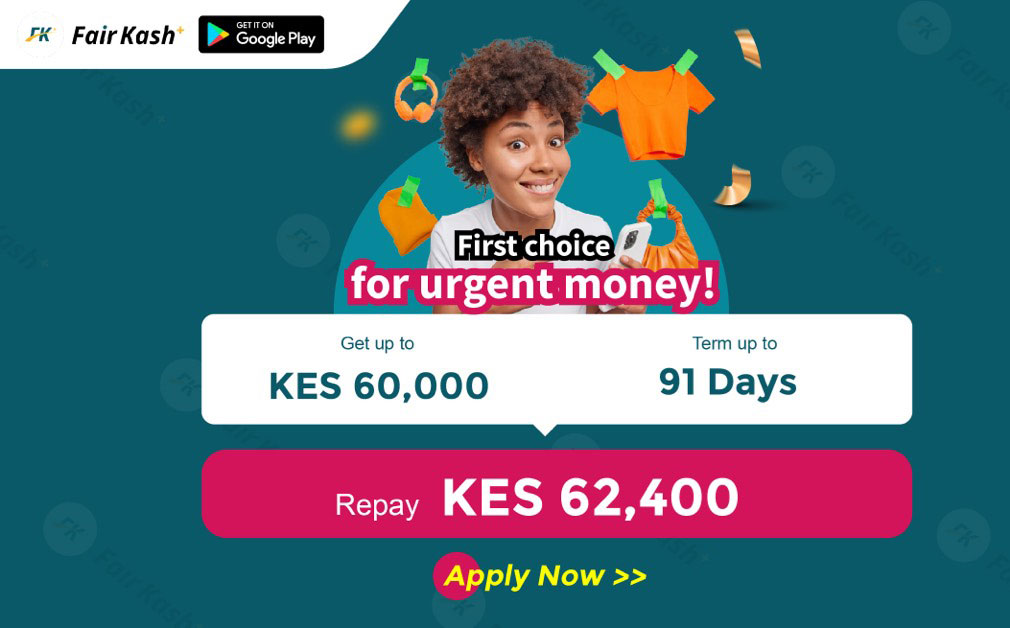

The Advantage of Early Repayment in Quick Online M-Pesa Loans Quick online M-Pesa loans have transformed the borrowing landscape, offering convenience and rapid access to funds. One of the unique features of these loans is the ability to repay the