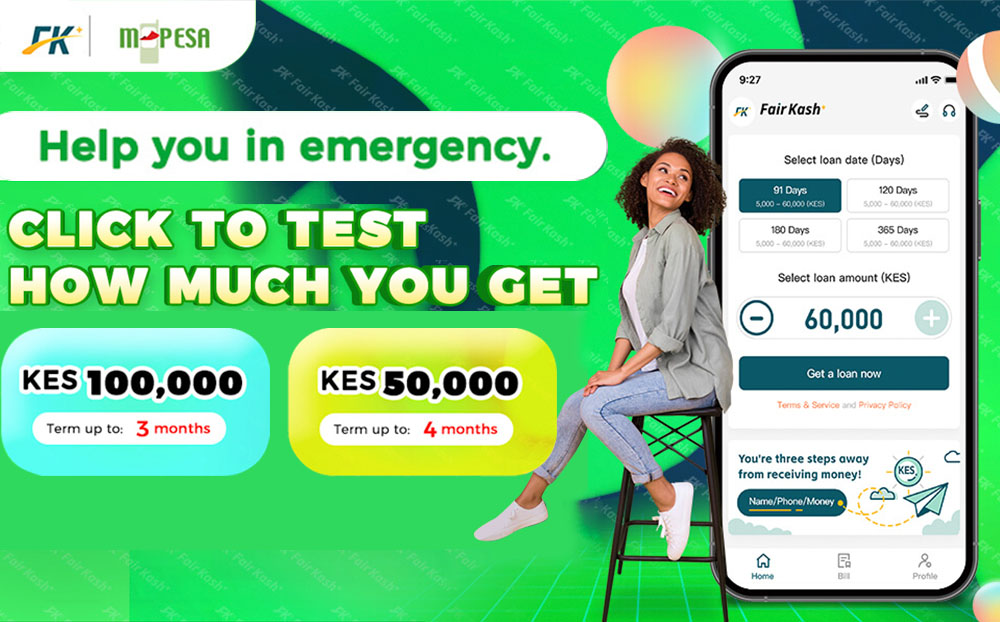

Are you ready to use a personal line of credit for emergency money?

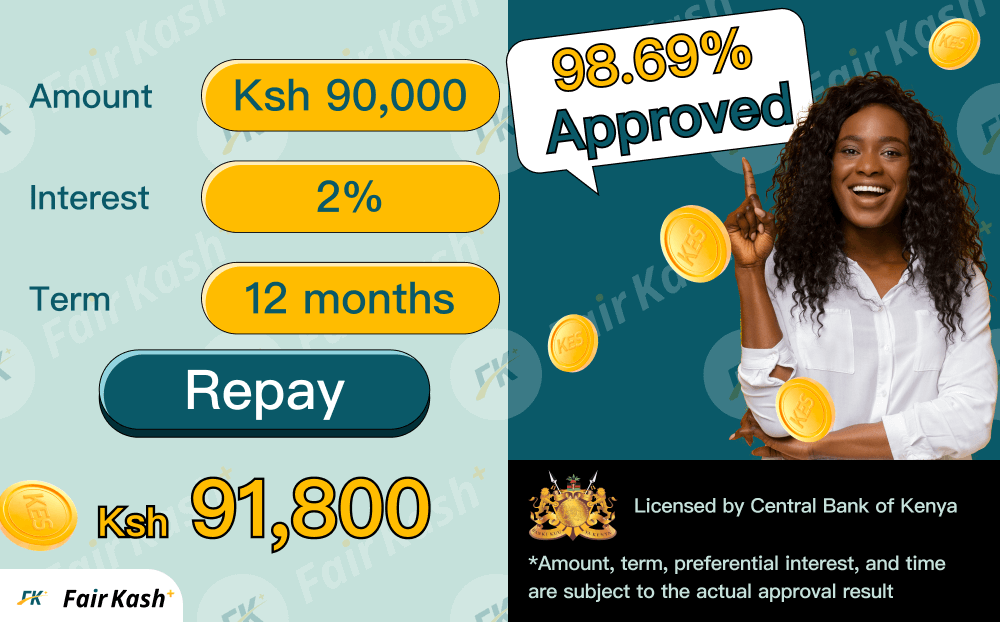

Using a personal line of credit for emergency money can be a practical financial tool if managed responsibly. Here are some considerations to help you decide if it’s the right choice for your situation: Advantages: Flexibility: A personal line of