Is the FairKash+ personal loan approval process easy?

Erick Yang

September 22, 2023

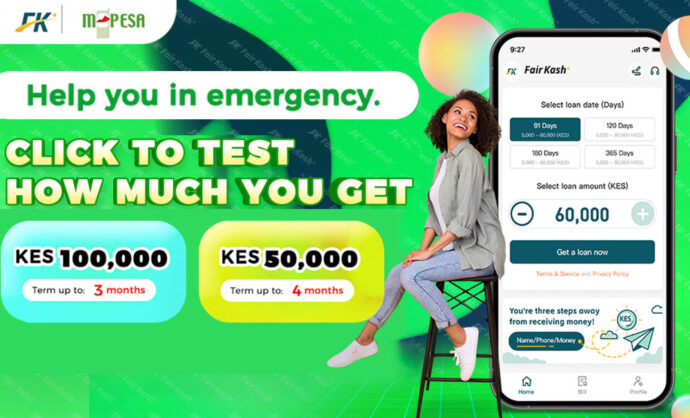

In Kenya‘s fintech landscape, FairKash+ has emerged as a popular online personal loan platform. For individuals in need of funds to meet significant financial requirements, whether it’s buying a home, starting a business, or consolidating debt, FairKash+ offers a convenient solution. In this article, we’ll delve into the FairKash+ personal loan approval process to help you understand if it’s straightforward and how to improve your chances of loan approval.

Understanding FairKash+ Personal Loans

Before exploring the approval process, let’s first understand how FairKash+ personal loans work. These personal loans are designed to meet larger financial needs and can encompass a range of purposes. FairKash+ is committed to providing flexible, transparent, and accessible loan solutions to cater to various types of borrowers.

The FairKash+ Personal Loan Approval Process

The FairKash+ personal loan approval process aims to ensure borrowers can access the loans they need while maintaining responsible lending practices. Here are the general steps for applying and getting approved for a FairKash+ personal loan:

1. Create a FairKash+ Account

If you don’t already have a FairKash+ account, the first step is to download the FairKash+ mobile app and create an account. Provide accurate personal information during the registration.

2. Complete Personal Profile

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Within your FairKash+ account, complete your personal profile and ensure the information is accurate. This information will be used to determine your loan eligibility.

3. Select Loan Type and Amount

Navigate to the loan application section within the FairKash+ app and choose the type of loan and the amount you need. You can use FairKash+’s tools to help calculate your repayment capacity and the loan amount that suits your needs.

4. Submit the Loan Application

Fill out the loan application form, including details like loan amount, repayment term, and other relevant information. Carefully read and agree to the terms and conditions associated with the loan.

5. Provide Necessary Documents

FairKash+ may require you to submit supporting documents to verify your identity and income. Prepare documents such as proof of identity, address verification, and income statements. Ensure these documents are accurate and complete.

6. Await Approval

FairKash+ will review your loan application and supporting documents. This process may involve a credit check and an assessment of your financial situation. Be patient as FairKash+ evaluates your eligibility for the high-risk personal loan.

7. Loan Approval and Disbursement

Once your high-denomination personal loan is approved, FairKash+ will transfer the funds directly to your bank account. You can then use these funds for your financial objectives.

8. Repayment

FairKash+ will inform you of the repayment schedule and terms. You can conveniently make repayments through the FairKash+ app, ensuring timely repayment of your loan.

Key Factors to Simplify the Approval Process

To simplify the FairKash+ personal loan approval process and increase your chances of approval, consider these key factors:

-

Strong Credit History: Build a positive credit history through responsible debt management.

-

Stable Income: Demonstrate a stable source of income to enhance your loan eligibility.

-

Accurate Documentation: Ensure all provided documents are accurate and up-to-date.

-

Loan Justification: Clearly communicate the purpose of the loan and how you intend to use it responsibly.

-

Repayment Capacity: Assess your ability to repay the loan, taking into account your income and existing financial commitments.

Safeguarding a high-denomination personal loan on FairKash+ is attainable with careful planning, responsible financial management, and adherence to the platform’s application process. Whether you are embarking on a significant financial project or addressing substantial financial needs, FairKash+ strives to make these loans accessible while promoting financial responsibility. By following the steps outlined above and considering the factors that can increase your approval chances, you can confidently apply for and manage a high-denomination personal loan through FairKash+.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status