Zero-risk loan and unsecured loan bring peace of mind

Erick Yang

August 18, 2023

Risk-Free Borrowing: The Peace of Mind Assurance from Unsecured Loans!

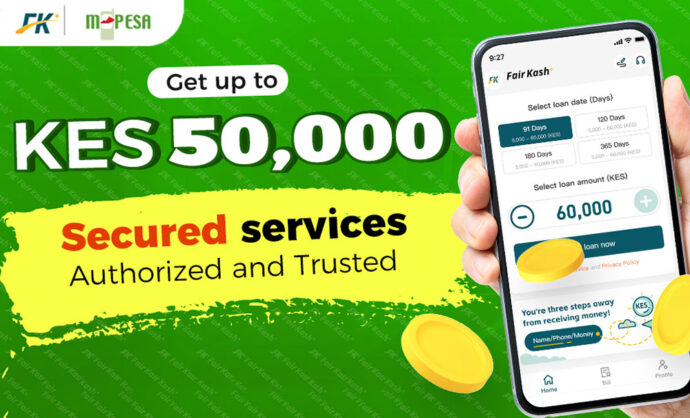

In the fast-paced modern world, where financial needs can arise unexpectedly, having access to reliable and secure borrowing options is crucial. Unsecured loans, often referred to as risk-free loans, have emerged as a solution that not only meets immediate financial requirements but also provides borrowers with a sense of security and peace of mind. FairKash+, a pioneering financial technology platform, has harnessed the power of unsecured loans to offer individuals a worry-free borrowing experience that is both seamless and secure.

Understanding the Essence of Risk-Free Borrowing

The term “risk-free borrowing” holds significant appeal in today’s uncertain financial landscape. Unlike traditional loans that might involve collateral or strict eligibility criteria, unsecured loans, such as those offered by FairKash+, present borrowers with an opportunity to access funds without the burden of providing assets as security. This absence of collateral minimizes the risk to borrowers, ensuring that their assets remain untouched even in unforeseen circumstances.

FairKash+ and the Promise of Peace of Mind

As a trailblazer in the financial technology sector, FairKash+ recognizes the importance of alleviating borrowers’ concerns while providing essential financial support. Here are the key factors that contribute to FairKash+’s reputation as a source of peace of mind through unsecured loans:

1. Transparency and Clarity

FairKash+ places transparency at the core of its operations. Borrowers are provided with comprehensive information about interest rates, fees, repayment terms, and more. This transparent approach empowers borrowers to make informed decisions, eliminating the fear of hidden costs and surprises.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

2. Customized Borrowing Solutions

Each borrower’s financial situation is unique. FairKash+ embraces this understanding and tailors borrowing solutions to suit individual needs. By accommodating different repayment terms and options, borrowers can confidently navigate their financial obligations, knowing that they have a plan that fits their circumstances.

3. Hassle-Free Application Process

FairKash+ stands apart with its user-friendly application process. With just a few clicks, borrowers can complete their applications without the need for extensive paperwork or in-person visits. This streamlined approach reduces stress and enhances convenience, reflecting FairKash+’s commitment to offering a worry-free experience.

4. Rapid Approval and Funds Disbursement

Urgency often defines financial needs, and FairKash+ recognizes the importance of swift responses. The platform’s efficient approval process ensures that borrowers receive prompt feedback, and once approved, funds are quickly disbursed to their designated bank accounts. This agility minimizes waiting times, allowing borrowers to address pressing financial matters without delay.

5. Stringent Security Measures

In the digital age, security is paramount. FairKash+ employs advanced security measures to safeguard borrowers’ sensitive information. This commitment to data security not only protects borrowers but also contributes to their peace of mind as they navigate the online borrowing process.

Applying for Risk-Free Borrowing with FairKash+

Applying for an unsecured loan with FairKash+ is a straightforward process that aligns with its commitment to convenience and security. Here’s a simple guide to getting started:

-

Download the App: Begin by downloading the FairKash+ mobile application from your app store.

-

Register an Account: Complete the account registration process by providing accurate personal information.

-

Submit Your Application: Choose your desired loan amount and repayment period, and then submit your application.

-

Receive Approval and Funds: Upon approval, the requested funds will be swiftly transferred to your designated bank account, allowing you to address your financial needs without delay.

Conclusion

Unsecured loans have revolutionized the borrowing landscape, offering individuals an avenue to secure funds without the burden of collateral. FairKash+ takes this concept a step further by ensuring that risk-free borrowing translates into a worry-free experience. Through transparency, personalized solutions, convenience, and security, FairKash+ empowers borrowers to navigate their financial needs with confidence and peace of mind. Nevertheless, responsible financial decision-making remains paramount, and borrowers should always exercise prudence when considering loans. By choosing FairKash+, borrowers can embrace the concept of risk-free borrowing and enjoy the tranquility that comes from knowing their financial needs are in capable hands.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status