Emergency instant loan, the best loan to use in Kenya?

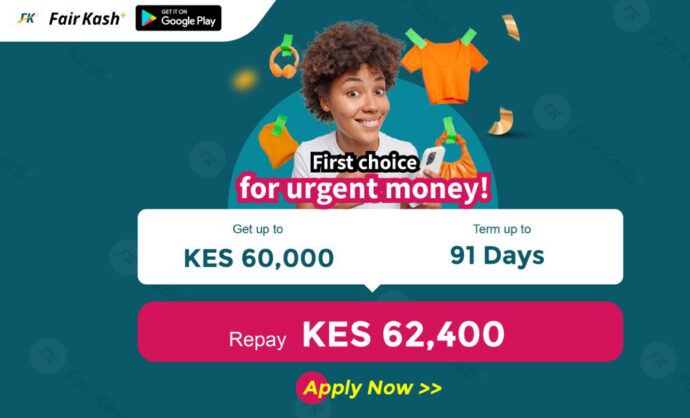

With the rapid advancement of financial technology, the financial services industry in Kenya is undergoing significant transformation. More and more people are turning to online loan applications to quickly obtain the funds they need when faced with urgent financial needs. Among the many loan applications available, FairKash+ stands out as one of the most popular and user-friendly instant loan platforms in Kenya.

I. Addressing Urgent Financial Needs with Instant Loans

In life, we often encounter urgent financial needs, such as paying unexpected bills, medical emergencies, or temporary financial difficulties. Traditional bank loans usually involve lengthy approval processes and complicated procedures, making it difficult to meet urgent financial needs. However, FairKash+ in Kenya offers a fast and convenient solution, allowing borrowers to access emergency loans in the shortest possible time.

II. FairKash+ – The Best Loan App

1. Simple Loan Application Process: FairKash+ provides borrowers with a straightforward loan application process. Borrowers only need to register an account on the FairKash+ official website or mobile application, fill in necessary personal information and loan requirements, and submit the application. Compared to traditional loan applications, this process can be easily completed at home or anywhere with an internet connection, eliminating the need to visit physical banks.

2. Swift Approval and Disbursement: After borrowers submit their loan applications, FairKash+ utilizes advanced data analytics technology and intelligent risk assessment models for a rapid approval process. The approval result is usually available within a short period. Once approved, borrowers will quickly receive the loan amount, directly transferred to their designated bank account, enabling them to access the funds promptly.

3. Collateral-Free with Zero Risk Worries: Unlike traditional secured loans that require collateral, FairKash+ provides unsecured loans. Borrowers do not need to provide any collateral, making the borrowing process simpler and more convenient. This also reduces the borrower’s concerns about asset risks, allowing more people to easily obtain the needed funds.

4. Flexible Repayment Options: FairKash+ offers borrowers a variety of flexible repayment options. Borrowers can choose to make repayments through their personal accounts on the platform or set up automatic payments to ensure timely repayment and avoid additional fees due to late payments. This flexible repayment method allows borrowers to select the most suitable repayment option based on their individual circumstances, better managing their finances.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5. Information Security and Privacy Protection: FairKash+ places high importance on borrowers’ information security and privacy protection. The platform adopts advanced encryption technology and security measures, ensuring that borrowers’ personal information will not be disclosed or misused. Borrowers can confidently provide necessary identification and financial details on the platform, enjoying the convenience of loan applications while protecting their personal privacy.

III. How to Apply for Emergency Loans using FairKash+?

1. Download and Register FairKash+ Application: Firstly, download the FairKash+ application on your mobile device and proceed with the registration process. You need to provide basic personal information, such as name, mobile number, and email address, to create an account.

2. Complete the Loan Application Form: After logging into your FairKash+ account, you will find the loan application form. Fill in necessary information, including loan amount, loan term, and repayment method.

3. Provide Necessary Documentation: According to FairKash+’s requirements, you may need to provide certain essential documents, such as identification proof and bank account information. Ensure that the provided information is true and accurate to expedite the loan approval process.

4. Swift Approval: Once you have completed the application and submitted the necessary documentation, FairKash+’s system will quickly process the loan application.

5. Accept Loan Terms: If your loan application is approved, FairKash+ will send you the loan terms and contract. Before accepting the loan, carefully read the contract terms and ensure you understand the loan interest rates, repayment plan, and other relevant terms.

6. Disbursement: Once you accept the loan terms and sign the contract, the loan amount will be swiftly transferred to your designated bank account.

In situations of urgent financial needs, FairKash+ in Kenya is one of the best loan applications available. Its fast and convenient loan application process, collateral-free loan service, and flexible repayment options provide borrowers with convenience and reliability.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status