How can I get a 20,000 loan without documents?

Erick Yang

October 16, 2023

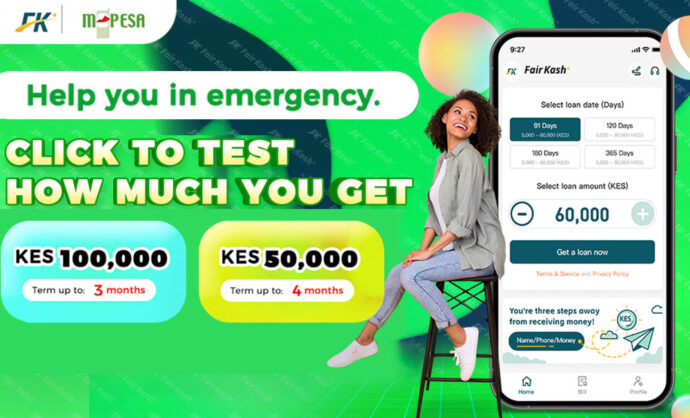

When unexpected financial needs arise, many of us seek quick and convenient ways to access funds. Traditional loans often require extensive documentation and a lengthy approval process, making them impractical for immediate expenses. FairKash+ offers a solution to this problem with their no-document loans. In this article, we’ll explore how to obtain a 20,000 loan without documents through FairKash+.

Understanding No-Document Loans:

No-document loans, as the name suggests, are loans that don’t require extensive paperwork or documentation during the application process. These loans are designed to provide quick and hassle-free access to funds, making them ideal for individuals facing sudden expenses or emergencies.

Advantages of No-Document Loans:

-

Speed: No-document loans are known for their rapid approval and disbursement. FairKash+ utilizes automated systems to expedite the lending process, ensuring borrowers receive their funds quickly.

-

Convenience: With no extensive paperwork to complete, the application process is convenient and straightforward. Borrowers can apply online or through FairKash+’s mobile app, eliminating the need for in-person visits to a bank.

-

Accessibility: These loans are accessible 24/7, allowing borrowers to apply whenever the need arises, even outside of traditional banking hours.

-

Flexibility: FairKash+ offers flexibility in terms of credit requirements. They understand that not everyone has a perfect credit history, making these loans more inclusive.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

How to Get a 20,000 Loan Without Documents from FairKash+:

-

Visit FairKash+ Website or App: Start by visiting FairKash+’s official website or downloading their mobile app from the app store.

-

Create an Account: Register for an account on the platform. You’ll need to provide basic personal information for the application.

-

Loan Application: Navigate to the loan application section. FairKash+ will ask you to specify the loan amount you need, which in this case is 20,000.

-

Provide Basic Details: FairKash+ may require some basic information, such as your name, contact details, and employment status.

-

Credit Check: FairKash+ may conduct a soft credit check. This is different from traditional banks that perform hard credit checks, which can impact your credit score. A soft check helps assess your eligibility.

-

Approval and Disbursement: Once your application is approved, FairKash+ will quickly disburse the 20,000 loan into your bank account. The disbursement speed can vary, but it’s typically quite fast.

Things to Keep in Mind:

-

FairKash+ may charge interest and fees on the loan, so be sure to review the terms before applying.

-

While no-document loans are more accessible, responsible borrowing is still essential. Ensure you can comfortably repay the loan on time.

-

Use these loans for genuine emergencies or urgent needs rather than for non-essential expenses.

In conclusion, FairKash+ offers a hassle-free way to obtain a 20,000 loan without documents. These loans are designed to meet immediate financial needs, and their accessibility, speed, and flexibility make them a valuable option for individuals seeking quick financial solutions. However, as with any financial product, it’s crucial to understand the terms and your repayment responsibilities to make the borrowing experience a positive one.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status