How to evaluate the safety and reliability of a quick loan application?

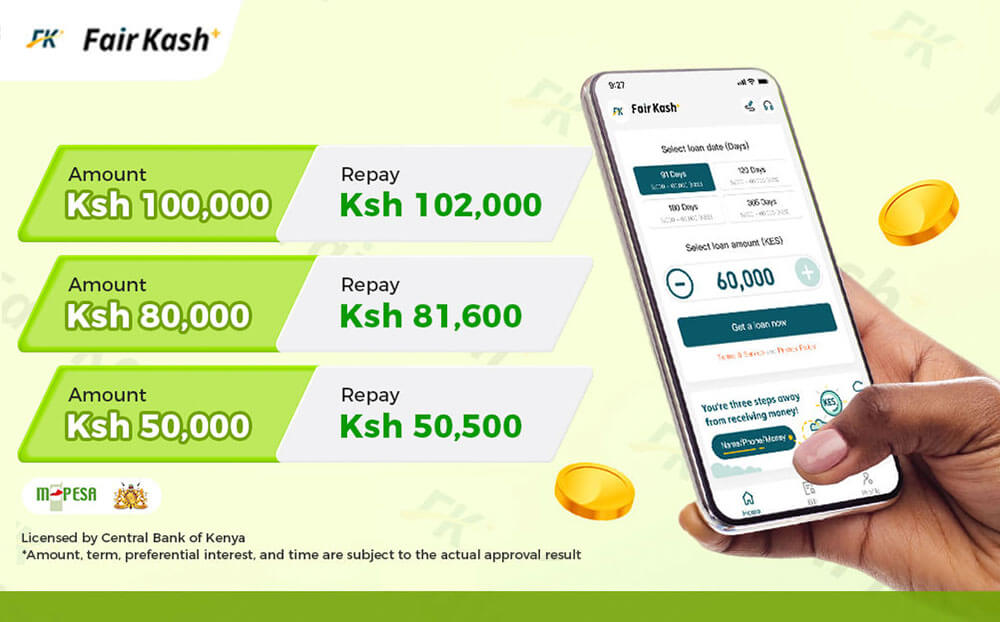

In the digital age, the safety and reliability of quick loan applications are paramount for users seeking financial assistance. FairKash+ prioritizes user security and reliability, setting the stage for an in-depth evaluation of these crucial aspects. Data Security: A Cornerstone