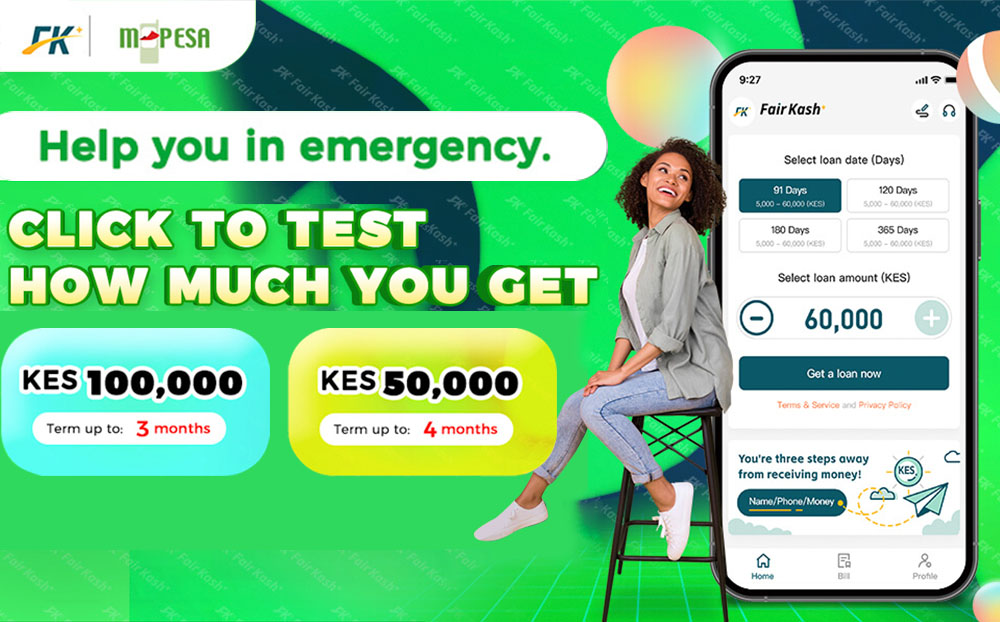

What are the hidden fees for the best loan applications?

When considering borrowing options from the best loan applications like Fairkash+ or similar platforms, understanding the fine print and potential hidden fees is crucial. While these platforms often emphasize transparency, borrowers should remain vigilant about potential additional costs. Origination Fees: