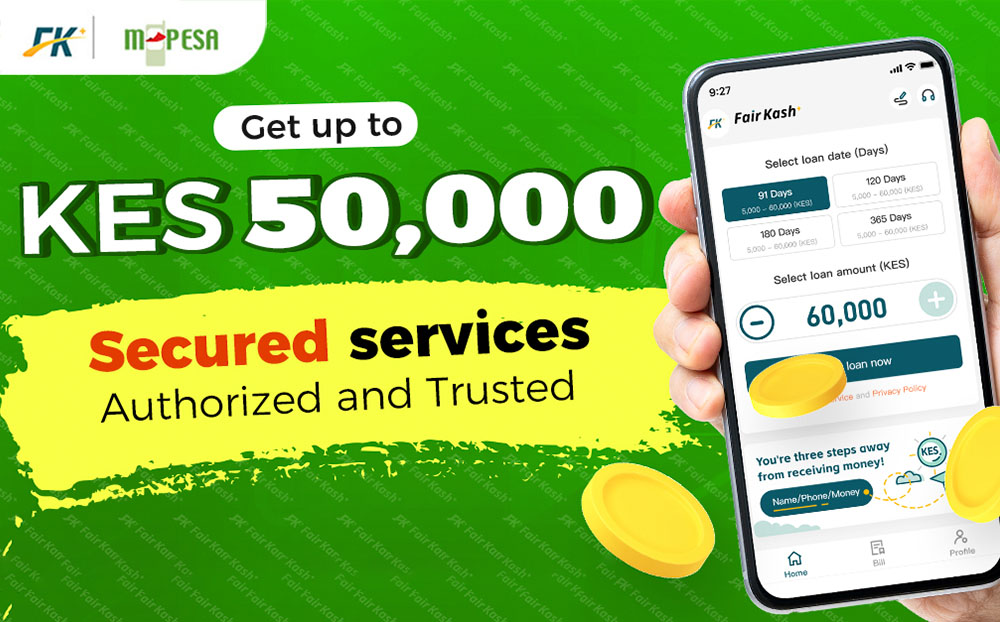

Personal online borrowing is easy, and FairKash+ provides you with help loans

Personal Online Loans Made Easy: How FairKash+ Provides Loan Assistance In today’s world, financial needs can arise unexpectedly, whether it’s for emergency expenses, medical bills, education costs, or other unforeseen situations. Fortunately, there are now many online lending platforms that