How long does it take to get approved for an urgent loan 10,000 on FairKash+?

Erick Yang

October 11, 2023

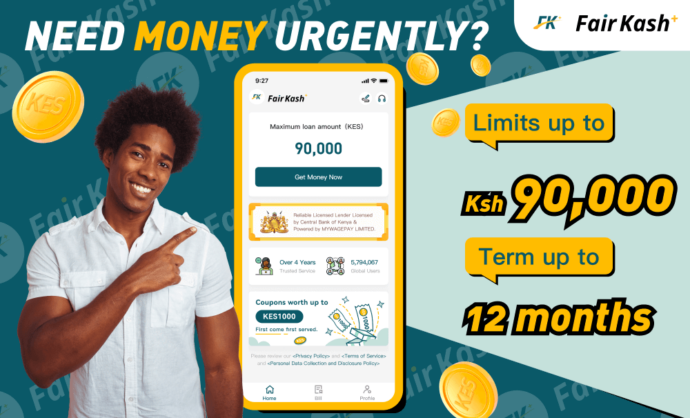

When you’re facing an urgent need for funds,FairKash+, as a provider of emergency loans, understands customers’ desire for a swift response. We will explore the approval time for applying for an urgent loan 10,000 on FairKash+ to help you better plan for and address your urgent financial needs.

1. Convenience of Online Applications

FairKash+ offers online loan applications, which means you can access their official website or app at any time and from anywhere to submit your application. This makes the entire application process more convenient and rapid. You don’t need to visit a bank branch in person or wait in queues, but rather can complete the application in a matter of minutes.

2. Speedy Review Process

FairKash+ typically conducts a fast review of the submitted loan applications. Their approval team carefully assesses your application, including your credit history, personal information, and provided documents. This process usually takes only a few hours, especially on business days.

3. Convenience of Electronic Signatures

FairKash+ typically uses electronic signatures to expedite the signing of loan contracts. This means you can sign the contract online, eliminating the need to wait for traditional mailing or in-person signings. This further reduces the waiting time.

4. Notification Speed

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Once your loan application is approved, FairKash+ promptly notifies you. You’ll receive the approval decision through SMS, email, or app notifications. This means you don’t have to wait for approval notices for an extended period.

5. Bank Transfer Speed

Once you accept the loan terms and sign the contract, FairKash+ swiftly transfers the loan amount to your bank account. Typically, this process takes only a few hours to a day.

6. Difference Between Business Days and Non-Business Days

It’s important to note that approval time may be affected by business days and non-business days. During business days, faster approval is generally possible since banks and financial institutions are operating as usual. On non-business days, you may have to wait a bit longer. Therefore, if you need funds urgently, it’s best to submit your application on business days.

In conclusion, applying for a KES 10,000 emergency loan on FairKash+ is typically a relatively quick process. Through online applications, swift reviews, electronic signatures, and rapid bank transfers, you can access the needed funds in a short amount of time. However, keep in mind that the actual approval time may vary based on individual circumstances and factors like business days and non-business days. Thus, submitting your application early is advisable to ensure you meet your financial needs promptly.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status