Urgent loan 10,000, how to apply to get it quickly?

Erick Yang

October 11, 2023

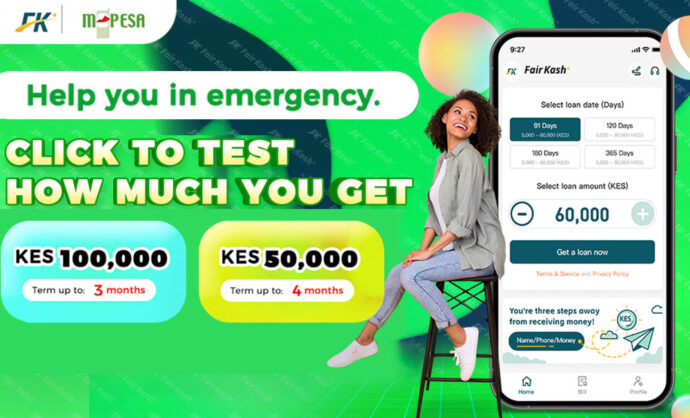

Sometimes life throws unexpected financial challenges our way, and we need quick access to funds. In such situations, FairKash+ can be your solution. This article explores how to apply for an urgent loan 10,000 with FairKash+ to swiftly address your urgent financial needs.

1. Prepare the Required Documents and Information

Before you start the application, make sure you have the necessary documents and information ready. This typically includes your identification, proof of employment and income, bank account details, and contact information. Being well-prepared with all the required documents and details can expedite the application process.

2. Visit the FairKash+ Official Website or App

FairKash+ offers a convenient online application channel. You can visit their official website(https://www.fairkash.co.ke/)or download their app to initiate the application process.

3. Create an Account

If you’re a new user of FairKash+, you’ll need to create an account. This usually involves providing some personal information for identity verification. If you’re already a registered user, simply log in.

4. Choose Loan Amount and Term

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

FairKash+ typically allows borrowers to select the loan amount and repayment term they need. During the application process, you can specify that you need a KES10,000 emergency loan and choose the repayment term.

5. Fill Out the Application Form

Complete FairKash+’s online loan application form. This entails providing personal information, contact details, employment information, and financial details. Ensure that the information you provide is accurate and complete to prevent delays in the application.

6. Submit the Application

Once you’ve filled out the application form on FairKash+’s platform, submit your application. Your application will be sent to their review team for assessment.

7. Review and Approval

FairKash+’s review team will assess your application, including your credit history and the information you’ve provided. Typically, they will complete the review in a short time and inform you promptly if your application is approved.

8. Accept Loan Terms

If your application is approved, FairKash+ will provide you with detailed information about the loan terms and interest rates. Take the time to carefully read and understand these terms.

9. Sign the Contract

After accepting the loan terms, you’ll need to sign the loan agreement. This can usually be done electronically through FairKash+’s platform.

10. Swift Fund Disbursement

Once you’ve signed the loan agreement, FairKash+ will quickly disburse the KES10,000 emergency loan into your bank account. Typically, the funds will be available within a short time to address your urgent needs.

11. Repayment Plan

Remember that after receiving the loan, you need to repay it according to the agreed-upon terms and schedule. Ensure that you adhere to the repayment conditions to maintain your credit history.

In conclusion, applying for a KES10,000 emergency loan with FairKash+ is a relatively fast process, especially when you’re well-prepared with the necessary documents and information. Quickly access their official website or app, create an account, complete the application form, sign the contract once approved, and receive the funds promptly to address your urgent financial needs. However, be sure to thoroughly read and understand the loan terms before borrowing, so you know your responsibilities.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status