What are the interest rates and fees for simple loans?

Erick Yang

September 19, 2023

Simple loans are a common financial tool designed to provide individuals with fast and convenient access to funds to meet urgent or short-term financial needs. However, like any loan product, understanding information about interest rates and fees is crucial. This article delves into interest rates and fees for simple loans and introduces how FairKash+ offers competitive loan terms for borrowers.

The Basics of Simple Loans

First, let’s review the basic principles of simple loans. Simple loans typically include the following core elements:

-

Principal: This is the actual amount of money you borrow from the loan provider, typically the total loan amount you need.

-

Interest Rate: The interest rate is the cost you pay to borrow the funds. It’s usually expressed as an annual percentage rate (APR) and determines the amount of interest you pay each month.

-

Additional Fees: Apart from interest, simple loans may involve other fees such as loan application fees, service fees, or prepayment fees.

-

Repayment Plan: The repayment plan outlines the details of how and when you need to repay the loan. This includes monthly repayment amounts, due dates, and the loan term.

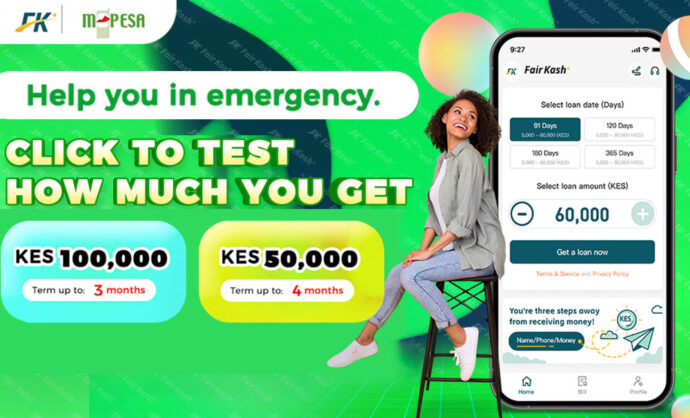

FairKash+’s Loan Terms

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

FairKash+ is an emerging fintech company dedicated to providing transparent and competitive loan terms for borrowers. Here are some ways FairKash+ adds value to borrowers regarding interest rates and fees:

-

Competitive Interest Rates: FairKash+ offers competitive APRs, allowing borrowers to borrow funds at a lower cost. This helps reduce the overall cost of the loan.

-

No Hidden Fees: FairKash+ commits to providing a transparent fee structure, ensuring borrowers understand all the fees they need to pay. This eliminates surprises and additional burdens.

-

Prepayment Policy: FairKash+ allows borrowers to make early repayments without incurring high additional fees or penalties. This offers borrowers more flexibility and control to get out of debt sooner.

-

Transparent Repayment Plans: FairKash+ provides clear and straightforward repayment plans, allowing borrowers to choose different repayment options and terms based on their financial situations. This ensures that repayment arrangements align with borrowers’ financial realities.

-

Innovative Credit Assessment: FairKash+ employs an innovative credit assessment method that enables more people to get loan approvals. This goes beyond traditional credit score models, considering borrowers’ repayment capabilities more comprehensively.

How to Compare Different Loan Terms

When considering applying for a simple loan, understanding the interest rates and fees offered by different loan providers is crucial. To make informed decisions, you can consider the following suggestions:

-

Compare Interest Rates: Compare the APRs from different loan providers to determine which one offers the most favorable terms. Lower interest rates typically mean lower overall costs.

-

Review Additional Fees: Carefully read the fine print regarding additional fees in the contract to ensure you understand all possible charges. This may include loan application fees, service fees, and prepayment fees.

-

Understand the Repayment Plan: Study the repayment plan, including monthly repayment amounts, due dates, and the loan term. Ensure that the repayment plan aligns with your financial capacity.

-

Consider Prepayment Policies: Understand the prepayment policies, including whether there are additional fees or penalties for early repayment. Choose a loan provider that allows early repayment without added costs.

-

Evaluate Credit Assessment Methods: If you have a less-than-ideal credit score, consider looking for loan providers that use innovative credit assessment methods to increase your chances of approval.

In conclusion, interest rates and fees for simple loans are key factors to consider when choosing a loan product. Borrowers should fully understand the terms offered by different loan providers and select the option that best suits their financial needs and goals. Meanwhile, emerging fintech companies like FairKash+ are working to provide transparent and competitive loan terms to help borrowers better manage their finances and achieve their financial objectives. Regardless of the loan you choose, always ensure a thorough understanding of the loan terms to make wise borrowing decisions.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status