What is the difference between mobile loans and credit card installment payments?

Erick Yang

September 19, 2023

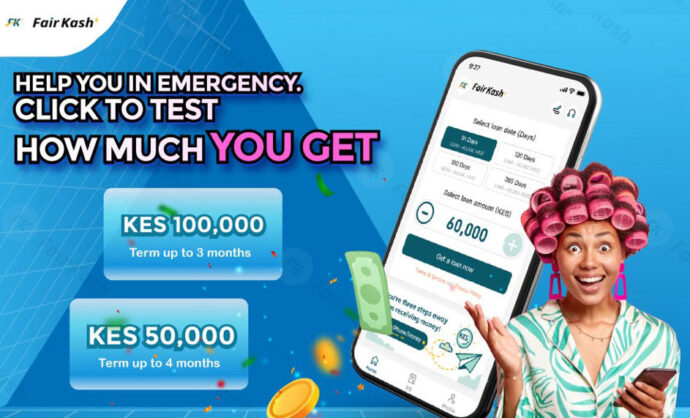

Mobile loans and credit card installment payments are two different forms of borrowing, each with its own set of distinctions. We will delve into the differences between mobile loans and credit card installment payments, with a focus on FairKash+ as an illustrative mobile loan provider.

Part One: Understanding Mobile Loans

1. Mobile Loan Basics:

Explain what mobile loans are and how they operate, emphasizing their characteristics as a standalone type of loan.

2. Application and Approval Process:

Describe the application process for mobile loans and how long it typically takes to get approved and access the funds.

3. Repayment Mechanisms:

Introduce how repayment works for mobile loans, including repayment plans and interest rates.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Part Two: Understanding Credit Card Installment Payments

1. Credit Card Installment Payment Fundamentals:

Explain how credit card installment payments function and how they are typically associated with credit card accounts.

2. Ownership and Usage of Credit Cards:

Discuss the necessity of holding credit cards and how they are used for installment payments.

3. Installment Plans and Interest Rates:

Detail credit card installment plans and the associated interest rates and fees.

Part Three: Contrasting Mobile Loans and Credit Card Installments

1. Source of Borrowing:

Highlight that mobile loans are an independent lending product, while credit card installments are usually linked to credit card accounts.

2. Application Process:

Compare the application processes for mobile loans and credit card installments, including approval speed and documentation requirements.

3. Interest Rates and Fees:

Explore the differences in interest rates and fees between mobile loans and credit card installments.

4. Repayment Mechanisms and Schedules:

Contrast how repayment is conducted for mobile loans and credit card installments, along with their respective repayment schedules.

Part Four: The Role of FairKash+

1. Advantages of Mobile Loans:

Highlight the advantages of FairKash+ as a mobile loan provider and why borrowers may choose mobile loans.

2. Advantages of Credit Card Installments:

Discuss the advantages of credit card installment payments and why, in certain situations, they may be the more suitable choice.

While both mobile loans and credit card installment payments offer ways to access funds, they exhibit distinct differences in terms of borrowing source, application process, interest rates, fees, and repayment mechanisms. Borrowers should select the lending method that suits their financial needs and credit situation. As a responsible mobile loan provider, FairKash+ is committed to offering transparent, flexible, and reliable loan solutions to meet a variety of financial needs.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status