Understand the quick loan market and choose the most suitable personal loan?

Erick Yang

September 15, 2023

The fast loan market offers a plethora of borrowing options, but selecting the right personal loan is a critical decision. This 1000-word article will guide you through understanding the fast loan market and making informed choices, with a focus on FairKash+.

Understanding the Fast Loan Market:

The fast loan market has evolved significantly in recent years, offering borrowers a wide array of choices. It’s crucial to have a clear understanding of the market dynamics to make the best decision for your financial needs.

1. Types of Fast Loans:

Explore the various types of fast loans available, including payday loans, installment loans, and personal lines of credit. Each type serves different purposes and comes with its terms and conditions.

2. Interest Rates and Fees:

Interest rates and fees can vary significantly among lenders. Thoroughly research the interest rates, origination fees, and any hidden costs associated with different loan options. FairKash+ provides transparent fee information to help you make an informed decision.

3. Repayment Terms:

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Consider the repayment terms offered by lenders. Some loans require full repayment within weeks, while others offer more extended repayment periods. Choose a loan with terms that align with your financial situation.

4. Online vs. Traditional Lenders:

Decide whether you want to borrow from an online lender or a traditional financial institution. Online lenders like FairKash+ often provide quicker approval and more convenient application processes.

Choosing the Right Loan with FairKash+:

FairKash+ is dedicated to helping borrowers find the right personal loan for their needs. Here’s how you can make the most of FairKash+ in your loan search:

1. Clear Assessment of Your Needs:

Start by assessing your financial needs. Determine the exact amount you need to borrow and the purpose of the loan. This clarity will help you narrow down your options.

2. Explore FairKash+ Loan Products:

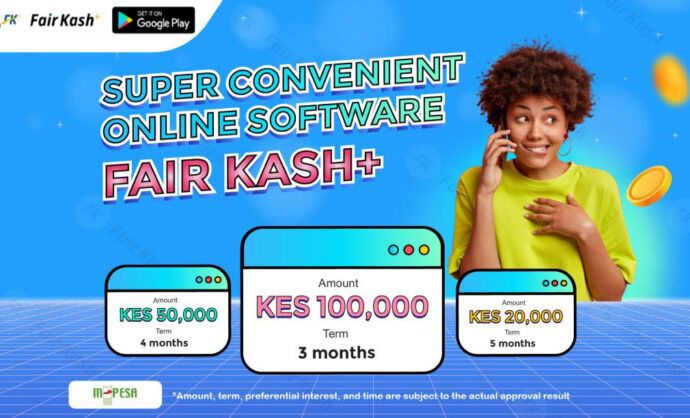

FairKash+ offers a range of loan products, each designed for specific financial needs. Explore these options to see which one aligns with your requirements.

3. Transparent Terms and Conditions:

FairKash+ provides transparent loan terms, including interest rates, fees, and repayment schedules. Understanding these terms is essential for choosing the right loan.

4. Eligibility Criteria:

Check FairKash+’s eligibility criteria to ensure you meet the requirements for your chosen loan product. Meeting these criteria increases your chances of approval.

5. Online Application Process:

FairKash+ offers an efficient online application process, making it convenient for borrowers to apply from the comfort of their homes.

6. Responsiveness and Support:

FairKash+ is known for its responsive customer support. Reach out to their team if you have any questions or concerns about the loan application process.

7. Compare Loan Offers:

Don’t hesitate to compare loan offers from multiple lenders, including FairKash+. This helps you find the most competitive terms and rates.

Conclusion:

Navigating the fast loan market and choosing the right personal loan is a crucial financial decision. By understanding the market, evaluating your needs, and exploring FairKash+’s offerings, you can make an informed choice that meets your financial goals while ensuring a smooth borrowing experience. FairKash+ is committed to assisting borrowers in finding the most suitable personal loan tailored to their unique circumstances.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status