How to deal with emergency loans for emergency expenses?

Erick Yang

September 15, 2023

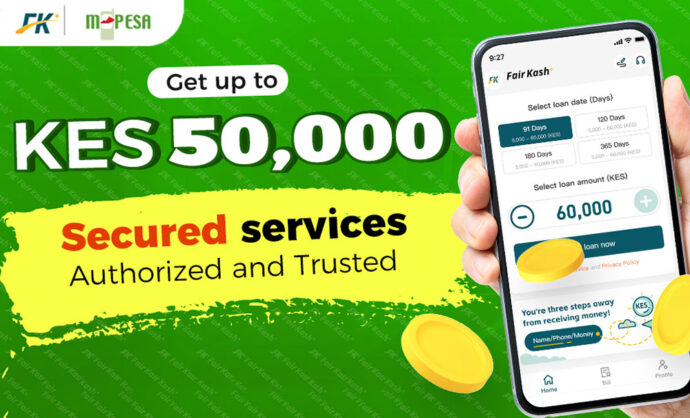

Facing unexpected expenses in life can leave many feeling helpless and perplexed. Unfortunately, unforeseen emergencies, be it medical crises, car repairs, household emergencies, or other unpredictable expenditures, can strike at any moment. In such situations, emergency loans can be an effective solution. In this article, we will introduce an emerging emergency loan solution – FairKash+, and explore how to leverage it to address urgent financial needs.

FairKash+ is a financial technology company dedicated to providing emergency loans. Its mission is to offer a fast, convenient, transparent, and fair lending platform for those confronting unexpected expenses. FairKash+ aims to make it easier for people to navigate the unpredictabilities of life through digital technology and innovative loan products.

Here are some key features of FairKash+ that you need to know:

1. Swift Approval and Disbursement

FairKash+ employs an efficient online loan application and approval process, typically completed within a few hours. This means that in times of emergency, you can quickly secure the funds you need without waiting for days or weeks.

2. Transparent and Fair Interest Rates

FairKash+ is committed to providing transparent and fair loan terms. Its rate structure is clear, with no hidden fees or traps. You can gain a clear understanding of the costs you will incur during the application process and make informed decisions before borrowing.

3. Flexible Repayment Options

The platform offers multiple repayment options to cater to different customer needs. You can choose your monthly repayment amount and term based on your own financial situation, ensuring that it doesn’t become a burden.

4. Security and Privacy

FairKash+ implements strict security measures to protect customers’ personal and financial information. You can collaborate with the platform with confidence, knowing that your data won’t be compromised or misused.

How to Apply for a FairKash+ Emergency Loan

Now, let’s take a look at how to apply for a FairKash+ emergency loan to address urgent expenses:

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

1. Register an Account

First, you need to visit FairKash+’s official website or mobile application and create an account. During the registration process, you will need to provide basic personal information such as your name, contact information, and social security number.

Once registered, you can start filling out the loan application. In the application, you’ll need to provide some information about your financial situation to help FairKash+ determine your loan eligibility. This information may include your income, employment status, and other financial commitments.

3. Review and Approval

FairKash+ will review your loan application, typically providing an approval decision within a few hours. They consider factors like your credit score, income, and other elements to determine your loan amount and interest rate.

4. Accept Loan Terms

Once your loan application is approved, FairKash+ will provide you with loan terms, including the interest rate, repayment term, and monthly repayment amount. Before accepting these terms, make sure to read and understand them thoroughly.

5. Loan Disbursement

Upon accepting the loan terms, FairKash+ will swiftly deposit the loan funds into your bank account. Typically, this process can be completed within 24 hours, allowing you to promptly address your emergency expenses.

How to Responsibly Use FairKash+ Emergency Loans

While FairKash+ provides a convenient solution for addressing urgent expenses, it’s essential to use emergency loans responsibly. Here are some recommendations to ensure you maintain financial health throughout the borrowing and repayment process:

1. Plan Carefully

Before applying for a loan, carefully assess your financial situation. Ensure that you genuinely need to borrow and explore other solutions like savings or alternative financial support.

2. Ensure Repayment Capability

Before accepting loan terms, make sure you have the ability to repay on time. Consider your monthly income, expenses, and other financial commitments to determine that repayment won’t put excessive strain on your finances.

3. Avoid Loan Abuse

Borrowing is a form of debt and should be treated with caution. Avoid borrowing more than you need or using loans for non-essential purposes. Responsible borrowing is key to maintaining your financial stability.

In conclusion, FairKash+ offers a practical and efficient way to address emergency expenses in a responsible and transparent manner. By following the outlined steps and using the service wisely, you can navigate unexpected financial challenges with confidence and ease.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status