Quick credit loan or traditional loan, how to choose?

Erick Yang

September 14, 2023

Choosing Between Fast Credit Loans and Traditional Loans:

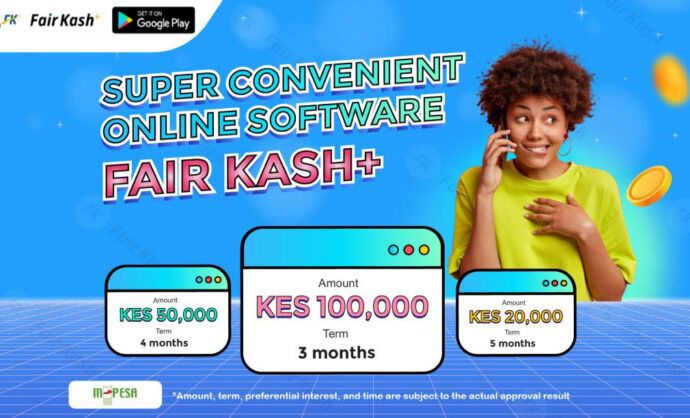

In today’s fast-paced world, financial needs can arise suddenly, leaving many individuals seeking quick access to funds. This has given rise to two primary options: fast credit loans and traditional loans. In this 1000-word article, we will explore the differences between these two types of loans and how FairKash+ provides a versatile solution for borrowers.

Understanding Fast Credit Loans:

Fast credit loans, often referred to as quick loans or payday loans, are designed to provide borrowers with swift access to cash. These loans are typically characterized by:

1. Speedy Approval: Fast credit loans are known for their quick approval processes. In many cases, borrowers can receive funds within hours of applying, making them ideal for urgent needs.

2. Limited Documentation: Unlike traditional loans, which may require extensive documentation and credit checks, fast credit loans often have minimal documentation requirements. Borrowers can apply with basic personal information and proof of income.

3. Short-Term Repayment: Fast credit loans are usually short-term loans, with repayment typically due on the borrower’s next payday. This short duration can help borrowers avoid long-term debt but can also lead to higher interest rates.

4. Higher Interest Rates: Due to the convenience and speed of fast credit loans, they often come with higher interest rates compared to traditional loans. Borrowers should be prepared for the higher cost of borrowing.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5. Smaller Loan Amounts: Fast credit loans typically offer smaller loan amounts, which may not be suitable for larger expenses or long-term financial goals.

Understanding Traditional Loans:

Traditional loans, offered by banks, credit unions, and other financial institutions, are more structured and typically involve:

1. Comprehensive Application Process: Traditional loans require a more thorough application process, including credit checks, income verification, and documentation of assets and liabilities. This process can take longer to complete.

2. Longer-Term Options: Traditional loans come in various forms, including personal loans, auto loans, and mortgages. They offer longer-term repayment options, allowing borrowers to spread their payments over several years.

3. Lower Interest Rates: Compared to fast credit loans, traditional loans generally have lower interest rates, making them a more cost-effective choice for borrowers with good credit.

4. Higher Loan Amounts: Traditional loans often provide access to larger loan amounts, making them suitable for significant expenses like home purchases or education.

Choosing Between the Two:

When deciding between fast credit loans and traditional loans, consider the following factors:

1. Urgency of Need: Fast credit loans are ideal for urgent, short-term needs, while traditional loans are better suited for planned expenses or larger financial goals.

2. Credit Score: Your credit score plays a significant role. If you have excellent credit, you may qualify for lower interest rates with traditional loans. Fast credit loans may be more accessible for those with lower credit scores.

3. Loan Amount: Determine the exact amount you need. If it’s a small, short-term expense, a fast credit loan may suffice. For larger expenses, traditional loans are more appropriate.

4. Repayment Capability: Consider your ability to repay the loan. Fast credit loans require prompt repayment, which can be challenging for some borrowers. Traditional loans offer longer repayment periods, which may be more manageable.

5. Interest Rates and Fees: Compare the total cost of borrowing, including interest rates and fees. Traditional loans generally have lower overall costs, but fast credit loans may be more convenient.

FairKash+ as a Solution:

FairKash+ offers a unique blend of both fast credit and traditional loan features. With quick approval processes and competitive interest rates, it provides borrowers with access to funds for urgent needs while maintaining responsible lending practices. Borrowers can choose from various loan options to best meet their specific requirements.

The choice between fast credit loans and traditional loans ultimately depends on your financial situation and the nature of your expenses. FairKash+ bridges the gap between these two loan types, offering a versatile lending solution for a wide range of borrowers. It’s essential to carefully assess your needs, financial capacity, and credit score when making your choice to ensure you select the loan that best suits your circumstances.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status