FairKash+ fast credit, a new way to unlock instant funds

Erick Yang

September 12, 2023

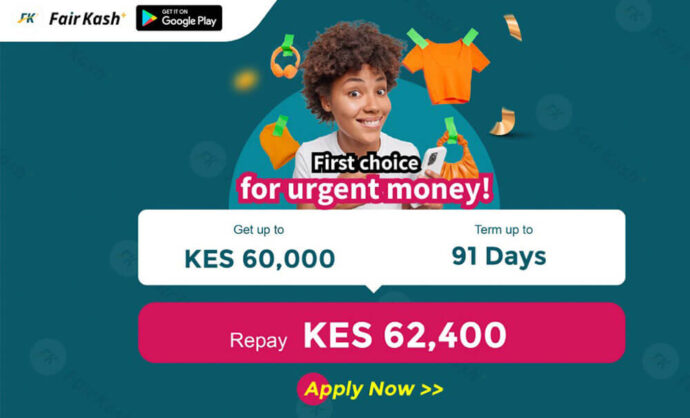

In today’s rapidly changing world, financial needs can arise unexpectedly. Whether you’re facing emergency medical expenses, unforeseen household costs, education expenses, or other urgent financial requirements, having a quick way to access funds is crucial. Fortunately, with the advancement of financial technology, there’s a brand new way to address these needs—FairKash+ Quick Loans. This article will provide an in-depth look at FairKash+ Quick Loans and how it has become a fresh approach to unlocking instant funds.

1. Understanding FairKash+

FairKash+ is an innovative fintech company dedicated to assisting individuals in swiftly meeting various loan needs through its convenient online platform. Regardless of whether you need to cover emergency expenses, seize investment opportunities, address short-term cash flow needs, or other financial requirements, FairKash+ has a solution for you. Its quick loan products allow you to access the necessary funds in the shortest possible time, enabling better financial management.

2. The Convenience of the Application Process

FairKash+ offers an incredibly convenient online loan application process. You can complete your application in just a few simple steps:

-

Selecting a Loan Product: Start by choosing the loan product that aligns with your needs. FairKash+ provides a range of options, including personal cash loans, emergency medical loans, education loans, and more.

-

Completing the Application: Fill out the loan application on FairKash+’s website or mobile app. Typically, you’ll need to provide some personal information, financial details, and the purpose of the loan.

-

Approval and Disbursement: FairKash+ will review your application and conduct a credit assessment. If your application is approved, the required funds will be deposited into your bank account within a short period.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Creating a Repayment Plan: You’ll need to establish a repayment plan based on the requirements of your chosen loan product and ensure timely repayments. FairKash+ offers various repayment options to accommodate different repayment capacities.

3. Swift Approval and Disbursement

FairKash+ is known for its swift approval and disbursement process. Many applicants can receive approval within minutes or hours of submitting their applications, allowing them to access the necessary funds quickly. This rapid response time is crucial for effectively addressing urgent financial needs.

4. The Convenience of the Mobile App

FairKash+ provides a user-friendly mobile app that allows you to access loan services anytime, anywhere. You can easily complete loan applications, view repayment schedules, and track your loan status, enhancing the overall loan experience.

5. Transparent Fee Structure

FairKash+ is renowned for its transparent fee structure. Before applying, you will have a clear understanding of the loan’s interest rates and fees, eliminating unnecessary concerns. This transparency ensures that you can make informed loan decisions.

6. Customer Support

FairKash+ offers customer support services to assist applicants in the loan application process, addressing inquiries, and providing support. Whatever questions or challenges you encounter during the loan application process, FairKash+ is dedicated to helping you.

Conclusion

FairKash+ Quick Loans provide a fresh way to unlock instant funds. Whether you’re facing an emergency situation or planned expenses, FairKash+’s loan assistance service is here to help you quickly meet your financial needs, enabling better financial management. Its convenience, rapid approval, transparent fee structure, and the convenience of the mobile app make it an ideal choice for addressing financial requirements.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status