How do I choose a cash loan repayment plan that’s right for me?

Erick Yang

September 7, 2023

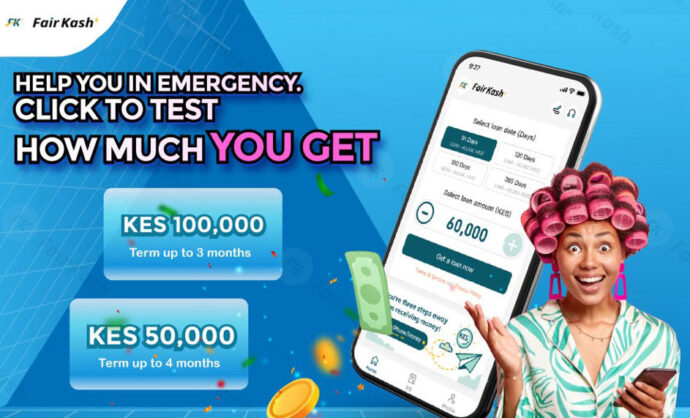

How to Choose the Right Cash Loan Repayment Plan with FairKash+

Choosing the right cash loan repayment plan is a crucial decision as it directly impacts your financial situation and loan experience. FairKash+, as a loan application, typically offers various repayment options to cater to different borrowers’ needs. In this article, we will explore how to select the most suitable cash loan repayment plan within FairKash+ and provide some advice to help you make informed choices.

1. Understand Different Repayment Options:

Before selecting a repayment plan, it’s essential to understand the various repayment options FairKash+ provides. These options typically include:

-

Monthly Installments: This is one of the most common repayment methods. You pay a fixed amount of principal and interest every month until the loan is fully paid off.

-

Weekly Installments: If you prefer more frequent payments, you can opt for weekly payments. This might lower the amount per installment but requires more frequent management.

-

One-time Lump Sum Payment: This means you repay the entire loan balance in one payment at the end of the loan term. This is typically used for short-term loans.

-

Flexible Repayment: FairKash+ may offer some flexible repayment options that allow you to make partial early repayments within the loan term as needed.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

2. Understand Interest Rates and Fees:

Before selecting a repayment plan, make sure you fully understand the loan’s interest rates and associated fees. Different repayment plans may come with varying interest rates and fee structures. Carefully read the loan terms to comprehend these aspects.

3. Consider Your Financial Situation:

Choosing the right repayment plan requires consideration of your personal financial situation. Evaluate your monthly income, expenses, and other liabilities to determine the repayment amount you can comfortably afford. Ensure that your repayment plan doesn’t unnecessarily strain your finances.

4. Consider the Loan Term:

Repayment plans are often tied to the loan term. A shorter loan term typically means higher monthly payments but lower overall repayment amounts. A longer loan term might reduce monthly payments but increase the total repayment amount. When choosing a repayment plan, consider how the loan term affects your financial situation.

5. Seek Advice from Loan Advisors:

If you have doubts or need additional advice regarding repayment plans, don’t hesitate to reach out to FairKash+’s loan advisors or customer support team. They can typically provide you with detailed information about different repayment options and assist you in selecting the most suitable plan.

6. Flexibility:

Consider the flexibility of the repayment plan. If you anticipate making early repayments or additional payments in the future, ensure that your chosen plan allows for these actions.

7. Budgeting:

Before selecting a repayment plan, create a financial budget to ensure you can make monthly payments on time. This helps avoid missed payments and additional charges.

8. Regularly Review Your Repayment Plan:

Once you’ve chosen a repayment plan, regularly review your financial situation to ensure that the plan still suits your needs. If necessary, you can consider changing your repayment plan.

Most importantly, choosing the right cash loan repayment plan requires careful consideration and planning. Make sure you understand the pros and cons of different options and make informed decisions based on your financial situation and needs. By selecting a repayment plan thoughtfully, you can better manage your finances and ensure a smooth repayment process.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status