How much can a personal consumption loan generally borrow?

Erick Yang

August 24, 2023

Personal Consumer Loans: How Much Can You Borrow?

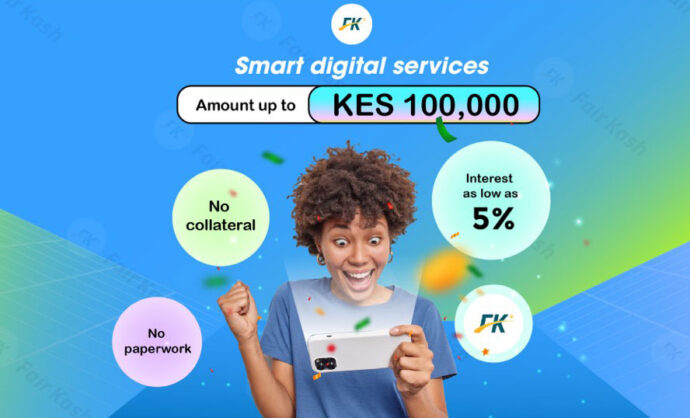

Personal consumer loans have become a popular choice for individuals seeking financial support for various needs and aspirations. Whether it’s a vacation, home improvement, medical expenses, or any other personal goal, personal consumer loans provide the necessary funds. In this article, we will explore the factors that determine how much you can borrow through FairKash+ for your personal consumption needs.

Loan Amount Determinants:

1. Repayment Capacity: One of the key factors that influence the loan amount is your repayment capacity. Lenders, including FairKash+, assess your monthly income, expenses, and existing financial commitments to determine how much you can comfortably repay.

2. Income Level: Your income plays a vital role in deciding the loan amount. A higher income generally indicates a higher repayment capacity, which may result in a larger loan amount being approved.

3. Credit History: While some online lenders like FairKash+ may consider alternative credit scoring methods, your credit history can still impact the loan amount. A positive credit history showcases your creditworthiness and can lead to higher loan approval amounts.

4. Employment Stability: Demonstrating stable employment enhances your ability to repay the loan. Lenders view consistent employment as a positive indicator and may approve a larger loan amount.

5. Loan Purpose: The purpose of the loan can also influence the loan amount. Different needs require varying amounts, and lenders like FairKash+ take this into account when approving your loan.

6. Debt-to-Income Ratio (DTI): Lenders often analyze your DTI ratio, which compares your monthly debt payments to your income. A lower DTI ratio indicates better financial stability and a higher likelihood of receiving a larger loan amount.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Advantages of FairKash+:

FairKash+ strives to provide borrowers with a flexible and convenient loan experience, offering several benefits:

-

Customized Loan Amounts: FairKash+ evaluates your individual financial situation and determines a loan amount that aligns with your repayment capacity and needs.

-

Transparent Terms: FairKash+ ensures that borrowers are aware of the loan terms, including interest rates, fees, and repayment schedules, before proceeding.

-

Fast Approval: FairKash+ aims to provide quick approval responses, allowing you to access funds promptly for your personal consumption needs.

-

User-Friendly Platform: The FairKash+ online platform is designed to be user-friendly, making the loan application process straightforward and accessible.

Conclusion:

The loan amount you can borrow for personal consumption needs through FairKash+ depends on various factors, including your repayment capacity, income level, credit history, employment stability, loan purpose, and DTI ratio. By evaluating these factors, FairKash+ ensures that you receive a loan amount that suits your financial situation and supports your personal goals. As you apply for a personal consumer loan, consider FairKash+ as a platform that values transparency, convenience, and your unique financial needs.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status