What is FairKash+ instant loan and how to apply?

Erick Yang

August 21, 2023

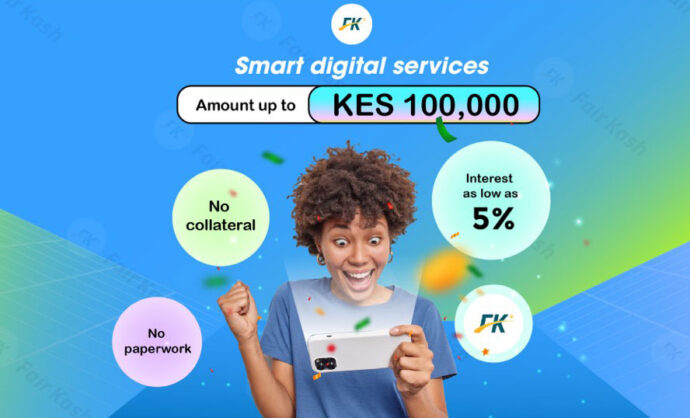

In the modern world, unforeseen economic demands can arise at any time, requiring prompt and reliable financial support. In this context, FairKash+ instant loans have become a popular solution, providing borrowers with a quick and convenient borrowing channel to meet urgent financial needs. This article will delve into what FairKash+ instant loans are and how to apply for them.

Introduction to FairKash+ Instant Loans

FairKash+ instant loans are an innovative type of loan service designed to offer borrowers a fast and convenient borrowing experience. Unlike traditional loan methods, FairKash+ prioritizes efficiency and flexibility. Leveraging modern technology and intelligent systems, FairKash+ can complete the loan application, approval, and disbursement process in a short period, creating a smoother borrowing journey for borrowers.

Steps to Apply for FairKash+ Instant Loans

-

Account Registration: Firstly, you need to create an account on the FairKash+ platform. This typically involves providing your personal information, contact details, and relevant documents.

-

Fill Out Application Details: After registering, you will need to complete the loan application form, which may include information about your income, employment status, loan amount, and more. This information helps FairKash+ assess your loan eligibility.

-

Identity Verification: FairKash+ often requires identity verification to ensure the accuracy and legitimacy of your information. This can be done by providing identity proof documents, employment verification, and other relevant documents.

-

Loan Approval: Once your application is submitted and passes verification, FairKash+’s intelligent system will quickly evaluate your loan application. This usually involves using algorithms to analyze your credit score, income level, and other factors.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Loan Agreement: If your application is approved, FairKash+ will provide you with a loan agreement outlining details such as the loan amount, interest rate, repayment schedule, and more. After agreeing to and understanding the terms, you can proceed to the next step.

-

Disbursement: Upon accepting the loan agreement, FairKash+ will promptly transfer the loan amount to the bank account you provided. This means you can access the required funds in a very short period.

Why Choose FairKash+ Instant Loans?

-

Swift Convenience: FairKash+’s intelligent process streamlines loan applications and approvals, allowing you to secure funds quickly, especially during urgent situations.

-

Flexible Repayment: FairKash+ usually offers a variety of repayment options, enabling you to choose a plan that suits your financial situation.

-

Minimal Formalities: Compared to traditional loans, FairKash+ typically requires fewer documents and formalities, making the borrowing process more straightforward.

-

Intelligent Risk Assessment: Utilizing modern technology, FairKash+ can accurately assess borrowers’ credit risks, providing more precise loan terms.

FairKash+ instant loans provide borrowers with a fast and convenient borrowing option to address urgent financial needs. Through an intelligent loan application and approval process, borrowers can access the required funds quickly while enjoying flexible repayment plans. If you encounter difficulties with financial needs, FairKash+ could be a worthwhile consideration to help you navigate unforeseen circumstances.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status