FairKash+ online Kenya loan,a good helper to solve short-term capital needs

Erick Yang

August 7, 2023

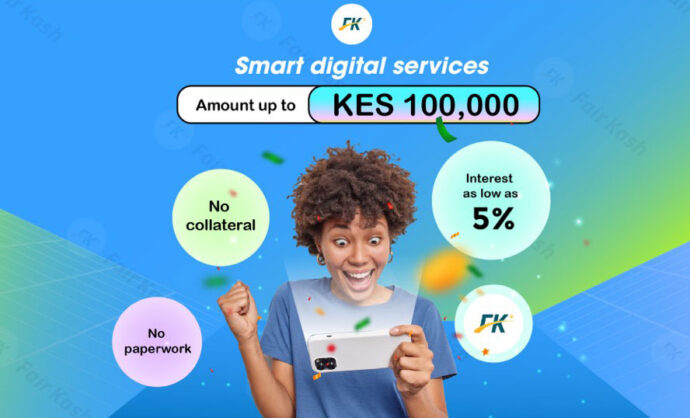

In today’s digital age, short-term capital demand has become a common problem in people’s daily life. FairKash+ online Kenya loan, as a good helper to solve short-term capital needs, is gradually being welcomed by more and more people. This paper will introduce the characteristics and advantages of FairKash+ online Kenyan loan and how to solve the short-term capital demand through it to help you better understand this loan product.

The characteristics of FairKash+ online loans

Quick approval: FairKash+ adopts advanced risk assessment system, which can complete loan approval in a short time and provide convenient and efficient loan service for borrowers.

No guarantee: FairKash+ online Kenya loan does not need to provide guarantee, as long as the borrower has good credit, the loan can be obtained.

Diversified repayment methods: FairKash+ provides a variety of repayment methods, such as matching principal and interest, monthly repayment, etc., to meet the needs of different borrowers.

Strict privacy protection: FairKash+ attaches great importance to the privacy protection of users and adopts multiple encryption technologies to ensure the security of borrowers’ information.

Strong reliability: FairKash+ cooperates with well-known financial institutions to provide reliable loan services for borrowers.

Low cost: FairKash+ online loan app does not need to set up physical outlets, so it can reduce the loan cost and provide borrowers with more favorable interest rates.

Convenient: FairKash+ online loan app can be applied anytime and anywhere, and borrowers are not limited by time and place.

How to solve the short-term funding needs through FairKash+

Know your own needs: Before applying for a loan, you need to know your own capital needs in order to choose the appropriate loan amount and term.

Choose the appropriate repayment method: choose the repayment method that suits you best according to your personal economic situation and loan purpose.

Submit an application: submit a loan application through FairKash+ online loan app and wait for the approval result.

Get a loan: If the application is approved, the borrower will get the required loan funds, which can be used to solve the short-term capital needs.

Repayment on time: The borrower needs to repay on time according to the agreed repayment method and time limit to avoid overdue fines and damage to credit records.

In a word, FairKash+ online Kenya loan is a good helper to solve short-term capital needs. Through its rapid approval, no guarantee, diversified repayment methods and strict privacy protection, it provides borrowers with greater flexibility and convenience in choice. When applying for a loan, you need to carefully understand the relevant terms and expenses to ensure the safety of your own funds. At the same time, it is necessary to plan funds reasonably to avoid excessive borrowing and default, so as to maintain a good personal credit record.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status