Online Kenyan loan App FairKash+: fast approval, same-day loan

Erick Yang

August 7, 2023

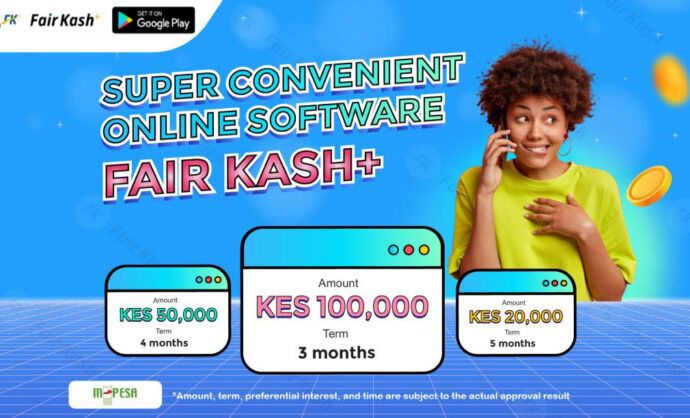

With the rapid development of science and technology, the financial service industry is undergoing tremendous changes. In Kenya, many people turn to online loan applications for quick solutions when faced with urgent capital needs. Among many loan applications, FairKash+ is highly regarded as a leading online loan platform. This paper will discuss the advantages of FairKash+, introduce its characteristics of quick approval and same-day lending, and how to apply for loans on this application.

I. Introduction to FairKash+

FairKash+ is one of the most popular online loan applications in Kenya, and is recognized for its efficient and efficient loan service. The platform uses advanced financial technology to provide convenient and fast loan application process and fast loan approval to meet users’ urgent capital needs. FairKash+ has become the first choice for more and more people to solve short-term capital needs because of its easy-to-use interface and safe and reliable service.

II. Fast-track approval process

Download and register the FairKash+ app.

Borrowers first need to download the FairKash+ application in the mobile app store and register. During the registration process, the borrower needs to provide basic personal information, such as name, mobile phone number and email address, in order to create an account.

Fill in the loan application form

Once the registration is completed, the borrower can log in to FairKash+ account and find the loan application form. Fill in the necessary information in the form, including loan amount, loan term and repayment method. Please be sure to provide accurate information to increase the success rate of loan application.

Provide necessary information

According to the requirements of FairKash+, the borrower may need to provide some necessary information, such as identification and bank account information. Providing true and accurate information will help speed up the loan approval process.

Quick approval

After submitting the loan application, FairKash+ will use its advanced data analysis technology and intelligent risk assessment model to conduct the approval process quickly. Compared with the traditional loan approval, FairKash+ has a faster approval speed and can usually give the approval results in a short time.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

III. Lending on the same day

Once the loan application is approved, FairKash+ will transfer the loan amount to the bank account designated by the borrower on the same day. This means that the borrower can get the required funds in the same day to solve the urgent capital demand. This feature makes FairKash+ unique in Kenya’s loan market and popular with users.

Flexible repayment methods

FairKash+ provides borrowers with flexible and diverse repayment methods to ensure that the repayment process is more convenient and smooth. The borrower can repay the loan through the personal account in the application, and can also set up automatic deduction to avoid overdue charges caused by forgetting to repay the loan. This flexible repayment method allows borrowers to choose the appropriate repayment method according to their own situation and better manage their finances.

V. Security and privacy protection

FairKash+ attaches great importance to users’ information security and privacy protection. The platform adopts advanced encryption technology and security measures to ensure that the borrower’s personal information will not be leaked and abused. Users can safely provide necessary identity and financial information on the platform, enjoy convenient loans, and protect personal privacy.

VI. Precautions

When applying for a loan with FairKash+, borrowers need to be cautious. First of all, make sure the loan is used reasonably and don’t abuse it. Secondly, rationally evaluate your repayment ability, ensure repayment on time, and avoid extra expenses and damage to your credit record. Finally, choose a reputable platform to avoid unnecessary risks caused by improper selection.

As a leading online instant loan platform, FairKash+ provides convenient loan solutions for Kenyan users with its characteristics of quick approval and same-day lending. Borrowers only need to download the application, fill in the application form and provide the necessary information, and they can get the emergency funds on the same day. However, borrowers should be rational when applying for loans, ensure repayment ability and avoid unnecessary burdens and risks. Only with caution can borrowers truly enjoy the convenience and advantages brought by FairKash+.

FairKash+’ s leading position in the field of financial services in Kenya stems from its excellent service and user-friendly experience. With the continuous progress of science and technology, more and more people choose the online instant loan platform to meet the urgent fund demand. FairKash+ stands out among many loan applications because of its quick approval and same-day lending.

In addition, FairKash+ is committed to providing users with a transparent and fair loan experience. Users can clearly understand the loan conditions, interest rates and repayment plans, and there are no hidden fees or complicated terms in the process of borrowing. This transparency makes users feel at ease about the loan process and can better plan their own finances.

In addition to providing emergency loan services, FairKash+ is constantly improving and expanding its products and services. FairKash+ strives to be a reliable financial partner of users by continuously optimizing the user experience, improving the efficiency of examination and approval, and cooperating with partners to launch more financial products.

However, as a borrower, we should always keep rational and responsible lending behavior. When considering loans, borrowers are advised to fully evaluate their financial situation and repayment ability. Loan is an important financial decision, and borrowers should decide the loan amount and term according to their actual needs and repayment ability. At the same time, the repayment should be made in full and on time, so as to avoid the extra expenses and credit record damage caused by overdue repayment.

To sum up, FairKash+ is Kenya’s leading online instant loan platform, which is highly praised by users for its fast approval and same-day lending. Borrowers can get the emergency funds on the same day through a simple application process. However, borrowers should be rational when applying for loans, ensure repayment ability and avoid unnecessary burdens and risks. Only under the premise of carefully choosing the loan platform and rationally lending, the borrower can truly enjoy the convenience and advantages brought by the online instant loan platform and realize financial freedom and healthy financial management.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status