Online Kenya loan, FairKash+ safe and reliable financing option

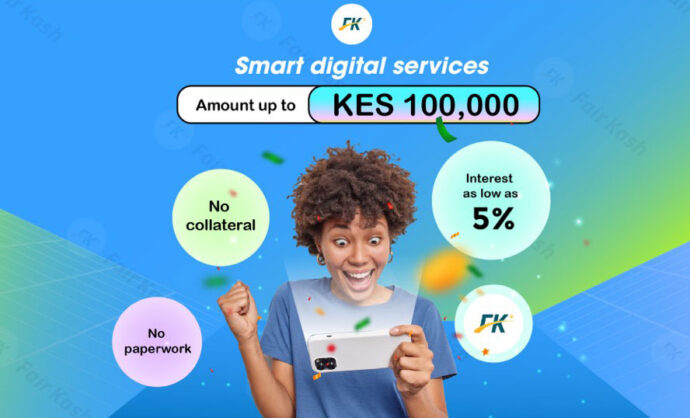

With the development of science and technology, online loan has become a convenient and fast financial service mode. For many Kenyan consumers, online Kenyan loan companies such as FairKash+ have become a safe and reliable source of funds. This paper will introduce the advantages and characteristics of online Kenya loan and FairKash+ as a financing option.

Online Kenya loan is a convenient and fast way to provide loan services through the Internet platform. Compared with traditional offline loans, online loans do not require borrowers to provide a large number of documents and certificates, which lowers the application threshold. At the same time, the audit process is faster and can generally be completed within a few working days. In addition, the repayment method of online loans is more flexible and can be customized according to the needs of borrowers.

FairKash+ is one of the leading brands in online Kenyan loan market, providing safe and reliable financial support. The company has a perfect loan process and a professional audit team to provide all-round support and guarantee for borrowers. On the FairKash+ platform, the borrower can complete the loan application in a few simple steps. First of all, you need to fill in personal information and loan purpose, and upload relevant supporting documents. Then, the system will automatically review and determine the loan interest rate and repayment method according to the borrower’s credit rating and repayment ability. In general, FairKash+ has a low loan interest rate and flexible repayment methods, which can be customized according to the needs of borrowers.

In addition to providing loan services, FairKash+ also provides borrowers with comprehensive repayment plans and account management functions. Borrowers can check their account information, repayment plans and repayment records at any time to ensure the transparency and security of loans. In addition, FairKash+ also adopts strict risk control measures to ensure the safety of borrowers’ funds. By using advanced data analysis and risk assessment technology, the company strictly examines and monitors every loan to avoid the occurrence of non-performing loans and bad debts.

For borrowers, it is very important to choose a loan platform with high credibility and high service. As a leading brand in Kenya’s loan market, FairKash+ has provided convenient and fast loan services for many borrowers. In the past few years, the company’s loans overdue rate and bad debt rate have been kept at a low level, showing its strong risk control ability.

Generally speaking, online Kenyan loan companies such as FairKash+ provide safe and reliable sources of funds for Kenyan consumers. Through its convenient loan process, personalized repayment methods and all-round support services, borrowers can easily solve short-term capital needs. When choosing a loan platform, we should choose a platform with high credibility and excellent service, and pay attention to the integrity of loan application and the timeliness of repayment. At the same time, we should also pay attention to the terms and expenses in the loan contract to avoid unnecessary troubles and losses.

When comparing the advantages and disadvantages of different loan platforms, we can consider the following aspects:

Credibility: Choose a loan platform with good reputation and qualification, and you can evaluate the reliability of the platform by looking at the evaluation, history and contact information of the platform.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Loan interest rate: Compare the loan interest rates of different platforms, and choose a platform with reasonable interest rate to avoid the extra cost brought by high-interest loans.

Audit speed: Considering the audit speed of the platform, choose a platform that can complete the audit in a short time to meet the urgent fund demand.

Repayment method and term: Know the repayment method and term of the platform, and choose according to your actual situation to avoid excessive repayment pressure.

Service quality: Choose a platform with good service attitude, timely response and effective problem solving to ensure the smooth and convenient loan process.

When choosing the online loan platform in Kenya, it is suggested to conduct full investigation and comparison to choose the most suitable loan scheme. By understanding the advantages and disadvantages of each platform and making wise choices according to our actual needs and conditions, we can make better use of the convenience and security of online Kenyan loans, solve the funding problem and achieve better financial planning.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status