How to get an emergency loan using FairKash+?

With the continuous advancement of technology, the fintech industry in Kenya has been flourishing, providing more convenience and options to meet urgent financial needs. In times of emergencies, such as medical emergencies, urgent family expenses, or other pressing needs, the Kenyan loan application FairKash+ has become the preferred choice for many individuals. This article will provide a detailed guide on how to apply for emergency loans through FairKash+, helping users quickly obtain the necessary funds during critical moments.

1. Introduction to FairKash+

FairKash+ is a leading online instant loan platform in Kenya, highly recognized for its efficient and speedy loan services. As a highly regarded loan application, FairKash+ is committed to assisting users in obtaining financial support during emergency situations. Leveraging innovative fintech solutions, this application offers a convenient loan application process and quick approval and disbursement, effectively meeting users’ urgent financial needs.

2. Download and Register FairKash+ Application

The first step is to download the FairKash+ application on your mobile device and proceed with the registration process. You can find the FairKash+ application on the Google Play Store. Upon completion of the download, follow the application’s instructions to fill in your personal information, such as name, mobile number, and email address, to create an account.

3. Complete the Loan Application Form

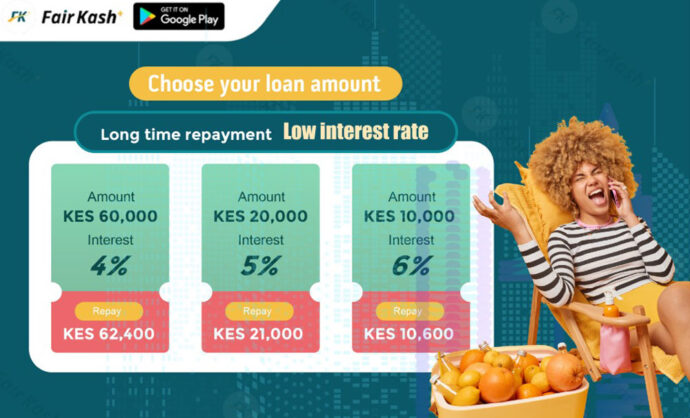

After logging into your FairKash+ account, you will find the loan application form. Fill in the necessary information, including the loan amount, loan term, and repayment method. Ensure the accuracy of the provided details, as this will increase the chances of a successful loan application.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

4. Provide Necessary Documentation

According to FairKash+’s requirements, you may need to provide certain essential documents, such as identification proof and bank account information. Providing authentic and accurate documentation will expedite the loan approval process.

5. Swift Approval and Disbursement

Once you submit the loan application, FairKash+ will utilize advanced data analytics and intelligent risk assessment models to promptly process the application. Compared to traditional loan approvals, FairKash+ offers faster approval, typically providing the result within a short period. Upon approval, the loan amount will quickly be transferred directly to the specified bank account, allowing borrowers to access the funds promptly.

6. Important Considerations

When using FairKash+ to obtain emergency loans, there are some key points to keep in mind. Firstly, ensure that you borrow only the necessary amount to avoid overindebtedness. Secondly, make a rational assessment of your repayment capacity to ensure timely repayment and avoid incurring additional fees and damaging your credit record. Finally, choose a reputable platform to avoid unnecessary risks resulting from improper choices.

Using FairKash+ to apply for emergency loans offers a convenient and fast way to meet urgent financial needs. By downloading the application, completing the loan application form, and providing the required documentation, users can quickly receive approval and disbursement of emergency loans, effortlessly resolving urgent financial requirements. However, borrowers should still approach loan applications with caution, ensuring their repayment capability to avoid unnecessary burdens and risks. Only with a prudent approach can borrowers truly enjoy the convenience and benefits that FairKash+ offers.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status