How long does it take to apply for a fast online mpesa loan?

The Timely Process of Applying for a Fast Online M-Pesa Loan

In the digital age, accessing quick online M-Pesa loans has streamlined the borrowing experience, offering convenience and rapid access to funds. The application process for a fast online M-Pesa loan typically involves several steps:

1. Online Registration:

-

Begin by registering on the lender’s website or mobile app. Fill in the required personal details, such as name, identification number, phone number, and email address.

2. Profile Verification:

-

Verification of your profile details may be required. This process might involve confirming your identity and linking your M-Pesa account to the loan platform.

3. Loan Application:

-

Navigate to the loan application section within the lender’s platform. Enter the desired loan amount and the repayment period, adhering to the eligibility criteria and loan limits set by the lender.

4. Document Submission:

-

Depending on the lender’s requirements, you might need to upload or submit documents such as identification cards, income proof, or address verification details.

5. Loan Approval Process:

-

After submitting the application, the lender assesses your details, performs credit checks, and evaluates your eligibility for the loan. This process varies in duration depending on the lender’s policies and systems.

6. Disbursement of Funds:

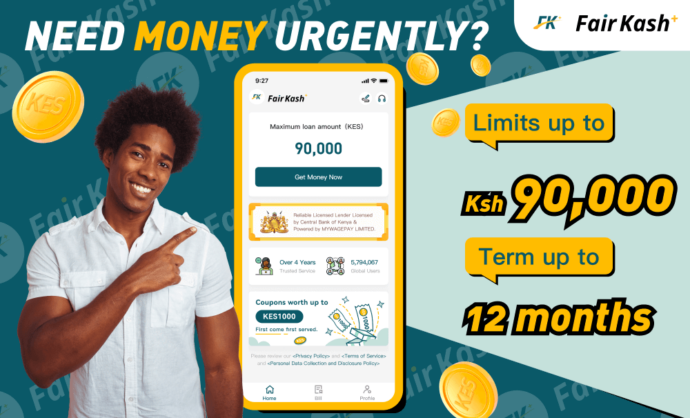

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Once approved, the funds are swiftly disbursed to your linked M-Pesa account. The duration for funds to reflect in your account may vary but generally occurs within minutes to a few hours.

Factors Impacting Application Time:

-

Completeness of Application: Providing accurate information and complete documentation can expedite the application process.

-

Lender’s Efficiency: Each lender has its processing timelines. Some lenders specialize in faster approvals and disbursements, while others may take longer.

-

Verification Process: The time taken for verification of your details, including identity, creditworthiness, and documentation, affects the overall application time.

Conclusion: The process to apply for a fast online M-Pesa loan is designed for swift and efficient borrowing. With minimal documentation and streamlined procedures, borrowers can complete the application within minutes to a few hours, depending on the lender’s processing efficiency.

While the time for loan approval and disbursal is typically quick, it’s essential to verify the specific timelines and procedures with the chosen lender or platform to ensure a smooth borrowing experience.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status