Will a credit inquiry be conducted during the online loan application?

Yes, most lenders perform a credit inquiry when processing an online loan application. There are two main types of credit inquiries: soft inquiries and hard inquiries.

-

Soft Inquiry: This type of credit inquiry doesn’t impact your credit score and is often used for pre-approval or initial application checks. It’s a preliminary check that lenders use to assess your creditworthiness without affecting your credit.

-

Hard Inquiry: A hard inquiry occurs when a lender reviews your credit report as part of the loan approval process after you’ve formally applied for credit. Hard inquiries can have a minor, temporary impact on your credit score. They show up on your credit report and indicate that you’ve applied for new credit.

When applying for an online loan, especially for a formal application that requires personal information and documentation, it’s likely that the lender will conduct a hard credit inquiry to assess your creditworthiness and determine the terms of the loan, including the interest rate.

It’s essential to be aware that multiple hard inquiries within a short period, especially for different types of loans, can have a cumulative effect on your credit score. However, credit-scoring models usually consider multiple inquiries for the same type of loan (e.g., auto or mortgage) within a certain timeframe as a single inquiry, minimizing the impact on your credit score.

Before applying for a loan, it’s a good idea to inquire with the lender about the type of credit inquiry they’ll conduct and how it might affect your credit score. Understanding this can help you make informed decisions about loan applications.

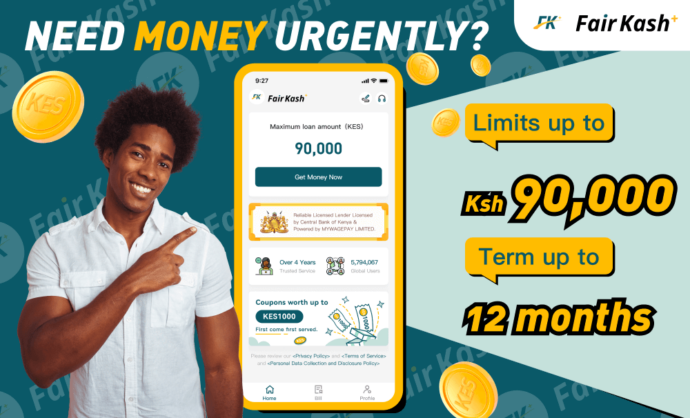

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status