Which is the most reputable loan app on Google Play Store in Kenya?

In the age of digital finance, finding a reputable loan app on Google Play Store is crucial, especially in Kenya, where financial inclusion is rapidly advancing. Among the multitude of options available, Fairkash+ stands out as one of the most reputable loan apps on the Google Play Store in Kenya. In this article, we’ll explore what makes Fairkash+ the top choice for borrowers seeking a reliable financial partner.

The Digital Lending Landscape in Kenya:

Kenya has been at the forefront of digital financial services in Africa. Mobile money platforms like M-Pesa have revolutionized the way people manage their finances, providing access to loans, payments, and more. The popularity of these services has paved the way for a thriving digital lending ecosystem.

The Rise of Fairkash+:

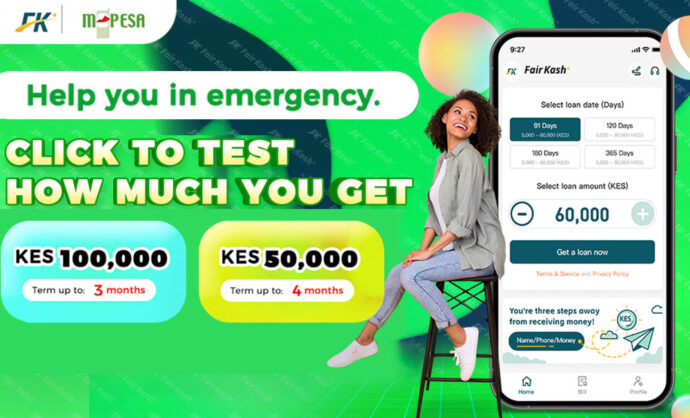

Fairkash+ has emerged as a leader in the digital lending space in Kenya. It has garnered a stellar reputation for several reasons:

-

User-Friendly Interface: Fairkash+ offers an intuitive and user-friendly mobile app. Borrowers can easily navigate through the application process, making it accessible to a wide range of users.

-

Fast and Convenient: Fairkash+ streamlines the loan application and approval process, providing borrowers with quick access to funds when they need them the most. The app’s efficiency is a major factor contributing to its popularity.

-

Transparent Terms: Fairkash+ maintains transparency in its loan terms, ensuring borrowers fully understand the interest rates, fees, and repayment schedules. This level of transparency builds trust among users.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Variety of Loan Products: Fairkash+ offers a range of loan products to cater to diverse financial needs, from small, short-term loans to larger, long-term ones. This flexibility allows users to choose loans that suit their specific requirements.

-

Customer Support: Fairkash+ has a dedicated customer support team ready to assist users with any queries or concerns. This commitment to customer service enhances the app’s reputation.

-

Security Measures: Fairkash+ prioritizes user data security, implementing robust encryption and security measures to protect sensitive information.

-

Positive User Feedback: The app has received numerous positive reviews from satisfied borrowers, further solidifying its reputation.

The Impact of Fairkash+ on Borrowers:

Fairkash+ has a positive impact on Kenyan borrowers:

-

Financial Inclusion: The app extends credit to individuals who may not have access to traditional banking services, promoting financial inclusion.

-

Convenience: Fairkash+ simplifies the loan application process, making it accessible to users with varying levels of digital literacy.

-

Financial Stability: Borrowers can use Fairkash+ to meet unexpected expenses, bridge financial gaps, and achieve their goals.

-

Borrowing Responsibly: The app encourages responsible borrowing and financial management through educational resources and transparent loan terms.

In Kenya‘s dynamic digital lending landscape, Fairkash+ has earned its reputation as one of the most reputable loan apps on the Google Play Store. Its commitment to user-friendly experiences, transparency, and financial inclusion has made it a trusted financial partner for Kenyan borrowers. As the app continues to evolve and cater to the changing needs of its users, it remains a frontrunner in the digital lending sector, empowering individuals to secure their financial futures.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status