Apps that provide micro loans to individuals in Kenya?

Micro loans have become a vital financial tool for individuals in Kenya, especially for those who lack access to traditional banking services. These loans, often provided by mobile apps, have transformed the way people access credit. Among the numerous apps offering micro loans in Kenya, Fairkash+ stands out as a prime example. This article explores the world of micro loans and how Fairkash+ and similar apps are empowering individuals.

The Rise of Micro Loans:

Micro loans are small, short-term loans designed to meet immediate financial needs. They have gained immense popularity in Kenya, thanks to the proliferation of mobile lending apps. These apps leverage mobile technology and data analysis to make lending decisions, providing individuals with quick and convenient access to credit.

Fairkash+ and Its Micro Loan Offering:

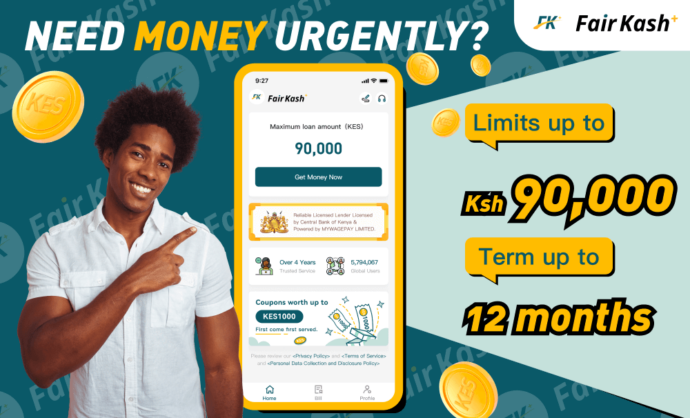

Fairkash+ is a leading player in the Kenyan micro lending space. It offers micro loans to individuals who need financial assistance for various purposes, from covering medical expenses to addressing urgent bills. Here are some key features of Fairkash+ and how it empowers individuals:

-

Quick and Convenient Application: Fairkash+ provides a simple and user-friendly mobile app that allows borrowers to apply for loans within minutes. The app’s interface is intuitive, making it accessible to a wide range of users.

-

Fast Approval: One of the most significant advantages of Fairkash+ is its swift approval process. Borrowers can receive loan approval in a matter of minutes, which is crucial when facing urgent financial situations.

-

Flexible Loan Amounts: Fairkash+ offers flexibility in loan amounts, allowing borrowers to choose the sum that best suits their specific needs. This versatility is essential for addressing different financial scenarios.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Transparent Terms: Fairkash+ maintains transparency in its loan terms and conditions, ensuring borrowers understand the interest rates, repayment schedules, and associated fees. This transparency enables individuals to make informed decisions.

-

Data Security: Fairkash+ prioritizes data security and employs advanced measures to protect users’ personal and financial information. This commitment to security builds trust among borrowers.

-

Timely Disbursement: Once a loan is approved, Fairkash+ excels in disbursing funds promptly. Borrowers often receive their funds within hours, allowing them to address their financial needs without delay.

The Impact of Micro Loans:

Micro loans provided by Fairkash+ and similar apps have a substantial impact on individuals in Kenya. They empower users to:

-

Handle emergency expenses, such as medical bills or home repairs.

-

Bridge financial gaps between paydays, avoiding costly late fees.

-

Invest in income-generating activities and small businesses.

-

Improve their credit scores by demonstrating responsible borrowing behavior.

Micro loans are changing the way individuals in Kenya access credit. Fairkash+ and similar apps are at the forefront of this financial revolution, providing quick, convenient, and accessible loans. The empowerment of individuals to meet their immediate financial needs is a significant step toward financial inclusion and economic growth in Kenya. These micro loans are not just loans; they are tools for financial empowerment and a path to a brighter financial future for countless individuals in Kenya.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status