What’s the most user-friendly instant loan app in Kenya?

In Kenya, the digital revolution has transformed the way people access financial services. With the proliferation of fintech apps, borrowers can now secure instant loans without the hassle and delays associated with traditional banking institutions. Among the array of lending apps available, Fairkash+ has gained prominence as one of the most user-friendly choices for Kenyan borrowers.

Why Fairkash+ Stands Out

Fairkash+ has won the hearts of Kenyan borrowers for various reasons, making it the go-to choice when seeking a user-friendly instant loan app:

1. Simplified Application Process

One of Fairkash+’s standout features is its user-friendly and intuitive interface. The app is designed to cater to users of all backgrounds and technical proficiency. Whether you’re tech-savvy or not, you’ll find the application process a breeze. You can swiftly enter your personal information, loan amount, and preferred repayment terms without any confusion or frustration.

2. Swift Loan Approval

In the world of instant loans, speed is of the essence. Fairkash+ understands this and ensures that users can access funds rapidly. With a streamlined approval process, you can expect a decision in just a matter of minutes, a critical feature for those facing emergencies or urgent financial needs.

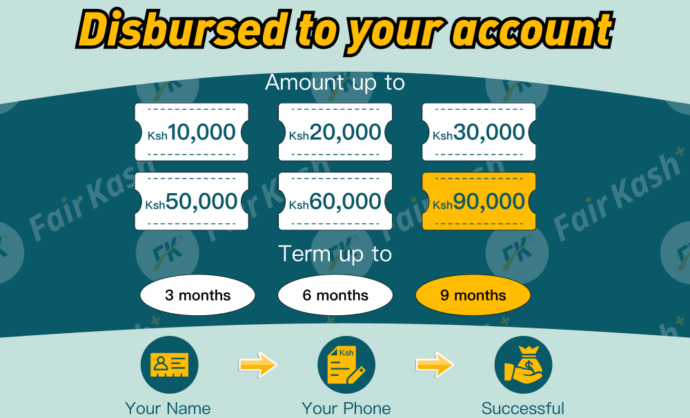

3. Flexible Loan Options

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Every borrower’s financial needs are unique. Fairkash+ recognizes this and offers flexibility in choosing your loan amount. Whether you require a small loan to cover immediate expenses or a more substantial sum for a significant investment, the app has you covered. This adaptability ensures that your loan aligns perfectly with your financial requirements and capacity to repay.

4. Clear and Transparent Terms

Fairkash+ is committed to transparency. Borrowers deserve to have a complete understanding of the terms and conditions associated with their loans. The app provides detailed information on interest rates, repayment schedules, and any associated fees, ensuring there are no hidden surprises. This transparency is essential in fostering trust between the lender and the borrower.

5. Responsive Customer Support

User-friendly loan apps recognize the importance of responsive customer support. Fairkash+ is no exception. It prioritizes providing top-notch customer service to address any questions, concerns, or issues borrowers may encounter. Having a reliable support system can be a game-changer when navigating the borrowing process, offering peace of mind and assistance when needed most.

6. Robust Security Measures

When it comes to financial transactions, security is paramount. Fairkash+ places a high premium on the security and privacy of user data and financial transactions. Your personal and financial information is treated with the utmost confidentiality and protected by advanced security measures.

7. Trusted Reputation

In a crowded field of loan apps, Fairkash+ has built a reputation as a reliable and trusted lending platform in Kenya. Its history of providing dependable and efficient lending services has earned the trust of borrowers throughout the country.

In Conclusion

The quest for a user-friendly instant loan app in Kenya leads many borrowers to Fairkash+. Its commitment to rapid access to funds, a simplified application process, flexibility in loan options, transparency, excellent customer support, security, and a trusted reputation makes it a top choice for Kenyans seeking user-friendly financial solutions.

In the fast-evolving landscape of fintech, Fairkash+ has emerged as a standout solution for instant loans in Kenya. Its dedication to user satisfaction and ease of use cements its position as one of the most user-friendly instant loan apps in the country.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status