How can I get a loan without hidden charges?

To minimize the risk of hidden charges when obtaining a loan, it’s crucial to be diligent and take the following steps:

-

Research Lenders: Start by researching and comparing different lenders, including traditional banks, credit unions, online lenders, and peer-to-peer lending platforms. Look for lenders with a transparent and trustworthy reputation.

-

Read the Loan Agreement: Carefully read the loan agreement and terms and conditions provided by the lender. Pay close attention to any fine print. This is where hidden fees or charges may be disclosed.

-

Ask Questions: Don’t hesitate to ask the lender about any fees or charges that are not explicitly mentioned in the loan agreement. If something is unclear, request clarification.

-

Understand the APR: The Annual Percentage Rate (APR) is a key indicator of the total cost of the loan, including both the interest rate and any associated fees. Ensure you understand the APR and how it impacts the cost of the loan.

-

Watch Out for Upfront Fees: Be cautious of lenders that require you to pay upfront fees before you receive the loan. Legitimate lenders typically deduct fees from the loan proceeds, rather than requiring you to pay out-of-pocket upfront.

-

Ask for a Fee Schedule: Request a complete fee schedule from the lender, outlining all potential charges related to the loan. This can help you anticipate costs.

-

Work with Reputable Lenders: Choose lenders with a good reputation and positive reviews from other borrowers. You can check online reviews and ratings to gauge a lender’s reliability.

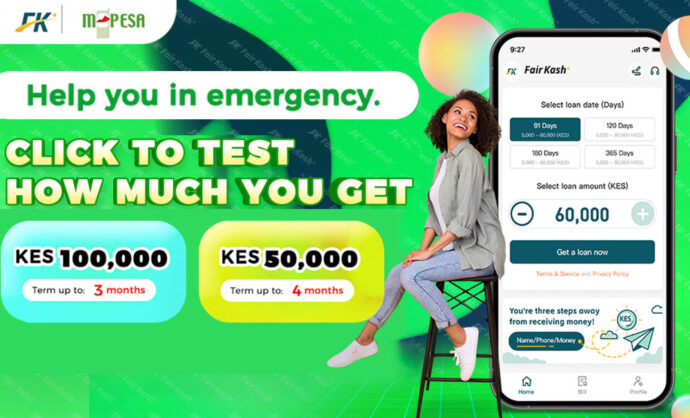

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

-

Consult a Financial Advisor: If you’re uncertain about the loan terms or fees, consider consulting a financial advisor or credit counselor for guidance.

-

Read and Understand Statements: After you’ve obtained the loan, carefully review your monthly statements. Ensure that you are not incurring unexpected charges or fees during the life of the loan.

Remember that all lenders are required to adhere to legal lending regulations and disclose the terms and fees associated with their loans. If you encounter a lender that does not provide clear information or tries to impose hidden charges, it’s advisable to seek a loan from a different, reputable source. Always keep a copy of your loan agreement and any communications with the lender for your records, as this documentation can be helpful in case of disputes or misunderstandings.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status