Can I get a personal loan with a 605 credit score?

A credit score of 605 is still considered relatively low, and it might be challenging to qualify for a personal loan with favorable terms. However, it’s not impossible, and there are lenders who may be willing to work with borrowers in this credit score range. Here are some options you can consider:

-

Online Lenders: Some online lenders specialize in providing personal loans to individuals with less-than-perfect credit. While you may be able to get a loan, be prepared for higher interest rates compared to borrowers with better credit scores.

-

Credit Unions: Credit unions are often more willing to work with their members, even those with lower credit scores. If you’re a member of a credit union, check with them to see if you can qualify for a personal loan.

-

Local Banks: Smaller community banks may be more flexible in their lending practices and more willing to consider factors beyond just your credit score.

-

Secured Personal Loan: If you have assets like a car or savings account, you could consider a secured personal loan. These loans use your assets as collateral, which can make it easier to qualify and secure a lower interest rate.

-

Cosigner: If possible, consider applying with a co-signer who has a stronger credit history. A co-signer agrees to take on the responsibility of the loan if you fail to make payments, which can improve your chances of approval.

-

Credit Building: Work on improving your credit score by paying bills on time, reducing outstanding debts, and avoiding taking on new debt. As your credit score improves, you’ll have access to better loan options.

It’s important to shop around and compare offers from different lenders. Additionally, be cautious of predatory lenders who may take advantage of individuals with lower credit scores. Always read and understand the terms and conditions of any loan you’re considering to avoid hidden fees or unfavorable terms.

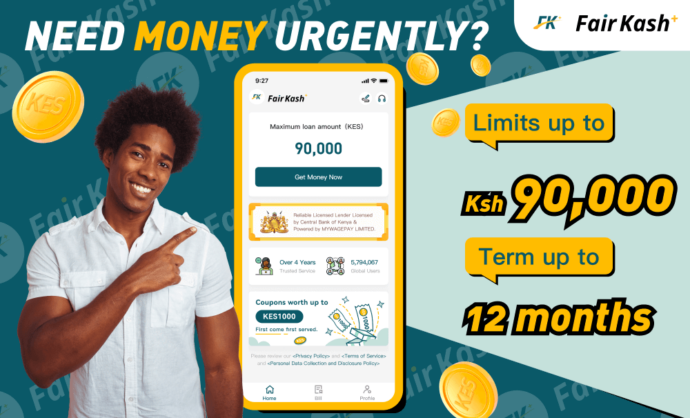

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status