How bad is a credit score of 571?

A credit score of 571 is considered a poor credit score. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. A score of 571 falls well below the average and can make it challenging to qualify for loans, credit cards, or other forms of credit, and if you are approved, you may be subject to higher interest rates.

Here’s a general breakdown of credit score ranges:

-

Excellent: 800 and above

-

Very Good: 740 to 799

-

Good: 670 to 739

-

Fair: 580 to 669

-

Poor: 300 to 579

With a credit score of 571, it’s important to work on improving your credit. You can do this by:

-

Paying Bills on Time: Make sure all of your bills, including credit card payments, loans, and utilities, are paid on time.

-

Reducing Debt: Try to pay down existing debts, particularly high-interest credit card balances.

-

Avoiding New Debt: Be cautious about taking on new debt, as applying for multiple credit accounts can negatively impact your score.

-

Checking Your Credit Report: Regularly review your credit report for errors or discrepancies. You can get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year.

-

Building Positive Credit History: Consider getting a secured credit card or becoming an authorized user on someone else’s credit card to establish a positive credit history.

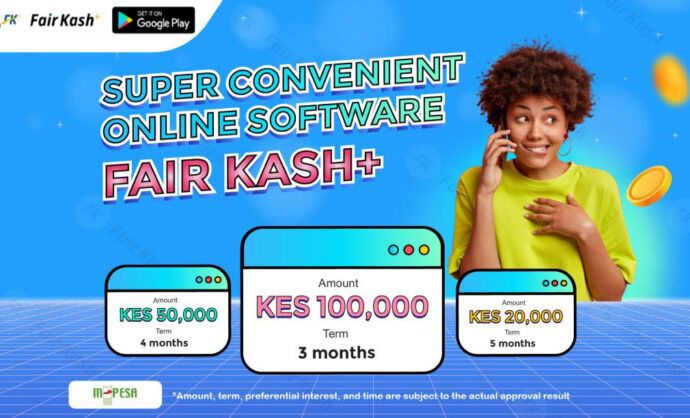

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

It may take some time to see significant improvement in your credit score, but with responsible financial habits, you can gradually raise your score and access more favorable credit options. It’s important to be patient and persistent in your efforts to rebuild your credit.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status