What are the differences between online mobile loans and traditional bank loans?

Erick Yang

October 16, 2023

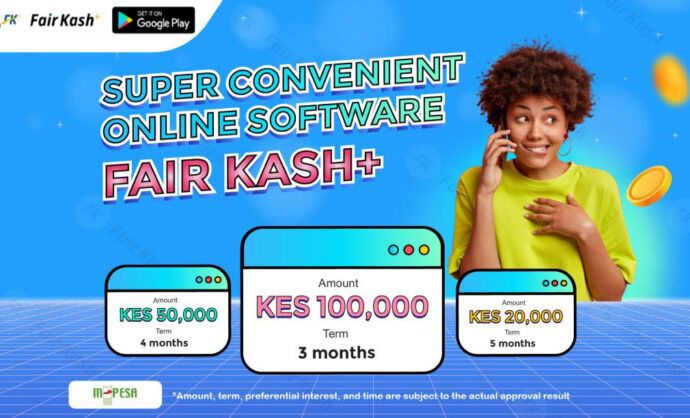

The world of lending has undergone a significant transformation with the advent of online mobile loans. Traditional bank loans and online mobile loans, like those offered by FairKash+, differ in several key ways. In this article, we will explore these differences and the advantages of each type of loan.

1. Accessibility and Convenience:

Traditional Bank Loans:

-

Accessing a bank loan typically involves visiting a physical bank branch during working hours.

-

The application process may require a face-to-face meeting with a loan officer.

-

Documentation and paperwork are often extensive, necessitating several trips to the bank.

Online Mobile Loans (FairKash+):

-

These loans are accessible 24/7 from anywhere with an internet connection, making them highly convenient.

-

The application process can be completed online or through a mobile app, eliminating the need for in-person visits.

-

Documentation is usually digital, reducing paperwork and saving time.

2. Speed of Approval and Disbursement:

Traditional Bank Loans:

-

Approval for bank loans may take several days to weeks, leading to delays in receiving funds.

-

The approval process involves extensive credit checks and underwriting, which can be time-consuming.

Online Mobile Loans (FairKash+):

-

Approval for online mobile loans is typically faster, often within minutes or hours.

-

Automated systems analyze applications, reducing the time required for approval.

-

Funds are usually disbursed promptly upon approval, addressing urgent financial needs.

3. Credit Requirements:

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

Traditional Bank Loans:

-

Traditional banks often have strict credit score requirements, making it challenging for individuals with lower scores to qualify for loans.

-

Collateral or a co-signer may be necessary for some bank loans.

Online Mobile Loans (FairKash+):

-

Online mobile loans may have more flexible credit requirements, and some do not rely solely on credit scores.

-

They may offer options for individuals with limited credit history or lower credit scores.

4. Loan Size and Terms:

Traditional Bank Loans:

-

Banks typically offer larger loan amounts with longer repayment terms.

-

These loans are suitable for substantial investments, such as home mortgages or business financing.

Online Mobile Loans (FairKash+):

-

Online mobile loans are often for smaller amounts and shorter terms, making them ideal for covering immediate or short-term expenses.

-

They are designed to address urgent or unexpected financial needs.

5. Interest Rates and Fees:

Traditional Bank Loans:

-

Banks may offer lower interest rates for individuals with excellent credit but higher rates for those with lower credit scores.

-

Fees and charges may vary, and borrowers should carefully review the terms.

Online Mobile Loans (FairKash+):

-

Interest rates for online mobile loans can vary, but they are often competitive.

-

FairKash+, for instance, offers transparent terms and rates to ensure borrowers are aware of all costs.

6. Repayment Options:

Traditional Bank Loans:

-

Traditional bank loans may offer various repayment options, such as fixed or variable rates and customized terms.

Online Mobile Loans (FairKash+):

-

Online mobile loans typically have straightforward repayment plans, simplifying the process for borrowers.

7. Customer Support:

Traditional Bank Loans:

-

Banks offer in-person customer support through local branches, which can be advantageous for certain individuals.

Online Mobile Loans (FairKash+):

-

Online mobile loans often provide customer support through digital channels, including live chat, email, and phone.

8. Financial Education:

Traditional Bank Loans:

-

Banks may offer financial education resources, but these are often not as readily accessible.

Online Mobile Loans (FairKash+):

-

Some online lenders, including FairKash+, prioritize financial education to help borrowers make informed decisions and improve their financial literacy.

In conclusion, online mobile loans and traditional bank loans cater to different financial needs and preferences. Online mobile loans, exemplified by FairKash+, excel in accessibility, speed, and flexibility. They are particularly well-suited for individuals requiring quick, smaller loans to address immediate financial challenges. However, traditional bank loans remain relevant for larger, long-term investments and for those who prefer face-to-face interactions. Understanding the differences between these lending options empowers individuals to choose the one that best aligns with their unique financial circumstances.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status