Understand the application process for online quick loans

Erick Yang

September 14, 2023

Understanding the Application Process for Online Fast Loans:

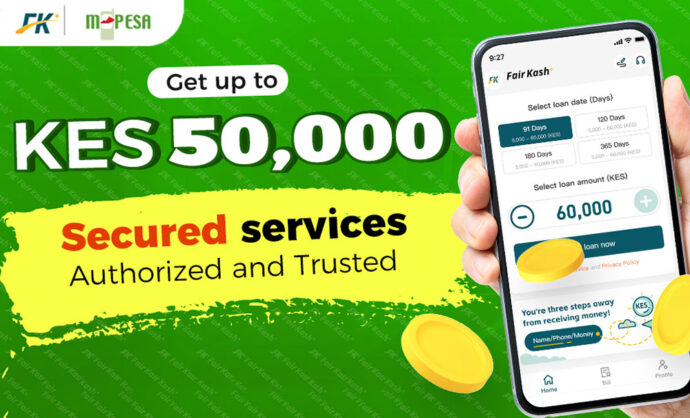

In today’s digital age, the convenience of online fast loans has become increasingly popular. With just a few clicks, borrowers can access the funds they need quickly and conveniently. This 1000-word article will provide an in-depth understanding of the application process for online fast loans, with a focus on FairKash+.

1. Registration and Account Setup:

The first step in applying for an online fast loan with FairKash+ is to register for an account on their platform. This typically involves providing personal information such as your name, contact details, and, in some cases, a username and password. FairKash+ takes data security seriously and ensures that your information is protected.

2. Complete Personal and Financial Information:

After registering, you will be required to provide additional personal and financial information. This may include details such as your employment status, income, monthly expenses, and banking information. FairKash+ uses this information to assess your eligibility and determine the loan amount you qualify for.

3. Choose Loan Amount and Terms:

Once your information is verified, you can select the loan amount and repayment terms that best suit your needs. FairKash+ typically offers a range of loan options, allowing borrowers to tailor their loans to their specific financial requirements.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

4. Credit Check and Evaluation:

FairKash+ will conduct a credit check to assess your creditworthiness. While they consider a broader range of factors than just your credit score, your credit history will play a significant role in the evaluation process.

5. Loan Approval and Offer:

Upon successful evaluation, FairKash+ will provide you with a loan offer, including details about the interest rate, repayment schedule, and any associated fees. It’s crucial to review these terms carefully to ensure you understand the cost of the loan.

6. Accept the Loan Offer:

If you are satisfied with the loan offer, you can accept it by electronically signing the loan agreement. This agreement outlines the terms and conditions of the loan, including the repayment schedule and any penalties for late payments.

7. Receive Funds:

Once you accept the loan offer and the agreement is finalized, FairKash+ will disburse the funds directly into your specified bank account. The speed of fund disbursement can vary, but online fast loans are known for their quick access to funds, often within a few hours.

8. Repayment Setup:

FairKash+ will work with you to set up a repayment plan that aligns with your financial situation. You will typically have the option to repay the loan in installments over the agreed-upon period.

9. Loan Management:

Throughout the loan term, you can access your loan information and repayment schedule through your FairKash+ account. It’s essential to stay on top of your payments to avoid late fees and maintain a positive borrowing experience.

10. Repayment and Completion:

Once you have repaid the loan in full, your borrowing relationship with FairKash+ is complete. Timely repayment can positively impact your credit history and may improve your eligibility for future loans with even better terms.

The application process for online fast loans with FairKash+ is designed to be straightforward and convenient. By following these steps and carefully reviewing the terms of your loan, you can access the funds you need quickly while ensuring a responsible borrowing experience. FairKash+ prioritizes transparency and data security throughout the process, giving borrowers peace of mind when applying for online fast loans.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status