How long is the repayment period of cash loan?

Erick Yang

August 23, 2023

FairKash+: Analysis of Repayment Period for Cash Loans

Cash loans are a source of emergency funds where borrowers can obtain the required funds within a short period. However, the repayment period is a crucial consideration as it determines the timeframe within which borrowers need to repay the loan. In this article, we will delve into the repayment period for cash loans, with a particular focus on FairKash+ platform’s repayment period policies.

Repayment Period for Cash Loans

The repayment period for cash loans is typically relatively short to cater to borrowers’ short-term financial needs. Generally, repayment periods may range from a few days to several months. However, the specific repayment period varies based on the loan type, loan amount, and the policies of the lending platform.

Factors to Consider

Choosing the appropriate repayment period is vital for borrowers as it directly impacts the installment amount and burden. Here are some factors to consider:

1. Financial Capacity: Borrowers need to assess their financial situation to ensure they have sufficient funds to repay the loan within the repayment period.

2. Loan Purpose: Select the suitable repayment period based on the purpose of the loan. For short-term expenses, a shorter repayment period might be more appropriate.

3. Interest Costs: Longer repayment periods lead to higher accumulated interest costs. Borrowers need to balance interest costs and repayment period.

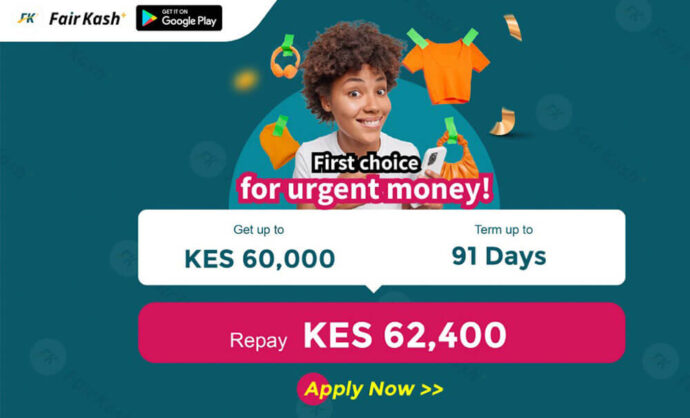

FairKash+’s Repayment Period Policies

FairKash+ is a platform that offers short-term cash loans, and its repayment period policies may vary depending on the loan type. On FairKash+, borrowers usually have the option to choose repayment periods of 7, 14, or 30 days to accommodate various funding needs and repayment capabilities. Borrowers can select the most suitable repayment period based on their circumstances.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

How to Choose the Right Repayment Period

Choosing the appropriate repayment period requires considering multiple factors holistically. Here are some suggestions:

1. Financial Assessment: Evaluate your financial capacity to ensure you have enough funds to repay the loan within the repayment period.

2. Loan Purpose: Choose the repayment period based on the loan’s purpose. Ensure the repayment period aligns with the fund’s purpose.

3. Interest Consideration: Factor in the impact of the repayment period on accumulated interest costs, balancing short-term repayment and interest expenses.

The repayment period for cash loans is typically short to cater to borrowers’ short-term financial needs. When selecting the repayment period, borrowers need to consider factors such as their financial situation, loan purpose, and interest costs. As a platform offering cash loans, FairKash+ allows borrowers to choose from different repayment periods to match their funding needs and repayment capabilities. Borrowers should make prudent choices based on their individual circumstances and ensure timely repayment to maintain a healthy credit history.

FairKash+: online cash loan

5.0 (1 million +)

Security Status

for IOS

5.0 (1 million +)

Security Status